Conventional wisdom suggests that a family’s assets will always jeopardize a student’s chances for financial aid. That is just plain wrong.

Mark Kantrowitz, one of the nation’s most respected financial aid experts, has estimated that only seven percent of families who file for financial aid see their aid eligibility decline because of their investment assets.

The reason why relatively few families need to worry about their net worth hurting aid chances is because of what the aid formulas disregard.

Neither the federal formula (FAFSA) nor the institutional formula (CSS/Financial Aid PROFILE) penalize families for their qualified retirement accounts, such as Individual Retirement Accounts, SEP-IRAs, 401(k)s, 403(b)s, KEOGHs and pension plans.

Important: While assets in qualified retirement accounts aren’t counted in the aid formula, distributions from retirement plans do count as income to the beneficiary. The one exception is when assets are rolled over from one retirement plan to another.

The federal formula (but not the PROFILE methodology) also doesn’t ask about your home equity. In fact, the FAFSA doesn’t even inquire if you own a primary residence. You’ve already learned in this course that many schools using the PROFILE do care about your home equity, but what they do with it can vary dramatically.

529 Accounts and Financial Aid

Parents seem particularly anxious about how their 529 savings accounts might hurt their aid chances. However, 529 assets are treated favorably because they are assessed as a parent asset. The federal formula assesses parental non-retirement assets at a maximum of 5.64% while the PROFILE assesses parent assets at up to 5%.

Here’s a quick example of what that means. If you have $50,000 saved up for college, the federal formula would reduce your eligibility for aid by $5.64 per $100 dollars of savings. With a $50,000 nest egg, financial aid eligibility would drop by just $2,820. And the parents in this example wouldn’t even get hit that much because of something called the Parents’ Education Savings and Asset Protection Allowance.

The federal financial aid formula automatically shelters some non-retirement assets of the parents, whether that be 529 accounts, taxable investment accounts, savings accounts, certificates of deposits, checking accounts or any other money that isn’t kept in qualified retirement accounts.

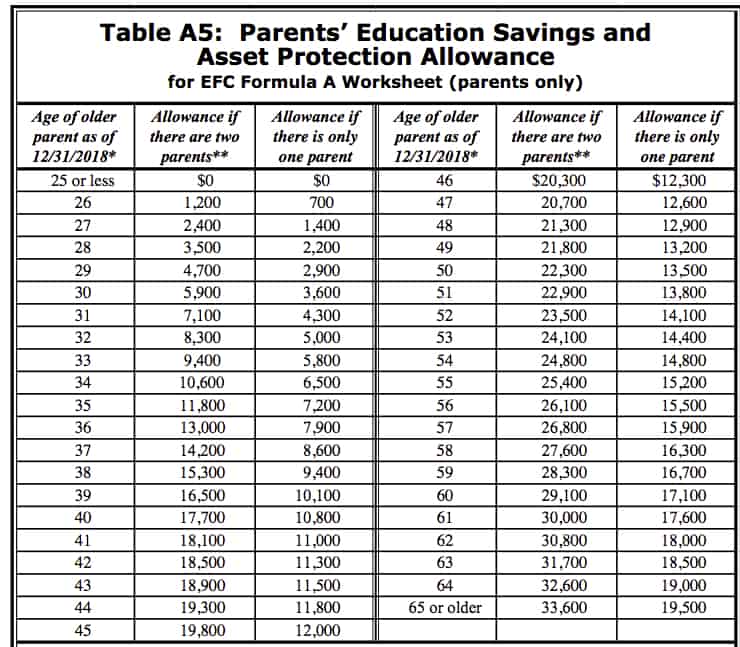

How much parents can shelter will depend on the age of the oldest parent. The calculation is based on the age of the parent on the last day of the year. The older the parent, the more the household can shield. A family can protect considerably more if parents are married.

The chart above was pulled from the latest federal EFC Formula Guide, 2018-2019 (page 19). The amounts on this chart will change yearly.

Let’s say the oldest parent is 50. The family would be able to shield $22,300 in 529 savings plan money, as well as any other cash kept in non-retirement accounts such as savings, checking and brokerage accounts.

The amount a mom or dad could shelter in a one-parent household is less. A 50-year-old single parent, for instance, could shelter just $13,500.

The Asset Allowance Has Been Shrinking

In the majority of recent year, the EFC asset protection allowance has been declining. It can fluctuate up or down.

The federal government annually adjusts the asset protection allowance tables based on rules first laid out in the Higher Education Act of 1965. The allowance relies heavily on what’s happening with Social Security payments. Specifically the rules measure the difference between a moderate family’s income and average Social Security benefits. When Social Security benefits rise faster than moderate family income, it results in a smaller asset protection allowance. This has created a perfect storm lately since family incomes have been flat or declining since 2009 while Social Security benefits have continued to grow during most of this time.

Making the formula even more flawed are built-in assumptions about inflation and rates of return that are wildly unrealistic and that make it appear that Americans don’t have to save as much for retirement.

You can learn more about the flawed nature of the asset protection allowance by reading this backgrounder: Asset Protection Allowance Plummets, Cutting Financial Aid to Middle-Income Students.

Student Assets and Financial Aid

The FAFSA formula allows students to shield all or a portion of their income.

For the 2018-2019 school year, a student can earn up to $6,570 for the year and not jeopardize aid. The PROFILE does not provide an allowance, but rather it assumes that students will contribute something to their college education. Many PROFILE colleges require that students contribute in the $2,200 range (the EFC is hiked by this much) for their education regardless of whether they have a job or a savings account.

Money that teens have in nonretirement accounts is assessed at stiffer rates than parent assets. The PROFILE assesses student assets at 25% and the FAFSA assesses them at 20%. Unlike their parents, students do not have an asset protection allowance.

Student asset example:

If a student has $2,000 in his checking account, schools would consider that $500 (PROFILE) and $400 (FAFSA) in that account would be available to pay for college. The student’s EFC that’s generated using the FAFSA methodology would be $400 (assuming he/she had no income beyond $6,420 that would boost the EFC further.)

Most students do not have to worry about their assets or income making much of an impact on their financial aid eligibility. Some exceptions are UGMA or UTMA and any other custodial accounts, which parents or grandparents might be using the save for college. These accounts will be assessed as student assets.

It can be a smart idea to move custodial money into custodial 529 plans because the money will then be treated by the FAFSA as parent assets at the much lower rate. Many PROFILE schools, however, will treat a custodial 529 account as the child’s asset. If this is an issue, contact a PROFILE college to determine how it treats custodial 529 accounts.

Trusts funds set up for the benefit of a child will also be considered a child asset even if the student doesn’t currently have access to the money.

Money that students have sitting inside a retirement account, such as a Roth IRA, does not count in aid calculations.

When Do You Calculate Your Assets?

While all financial aid formulas will want to know what the income for parents and the student via prior-prior tax returns, the financial aid applications only want you to share the value of you and your child’s assets on the day that you submit the FAFSA or PROFILE.

If the stock market has a bad day, this could be a good time for you to file your financial aid forms. It would also be better to file the applications after you have tapped your investment accounts to buy a car, pay a tuition bill, paid credit card bills or cover other expenses.

Hi Lynn, I took the February class but haven’t listened to all of the webinars yet. I don’t know if it is too late to ask a question. I think I found the answer above. We do have some cash that is just sitting. I was trying to figure out if it would look odd or hurt us if we all of a sudden put it in to 401k accounts. If I am reading above correctly, as long as we do it before filing the FAFSA this year we are OK. If I am not understanding this right please let me know. I also didn’t realize that there was an actual chart for how much cash you could have and it not hurt you. We did want to leave some cash that is easily accessible. My husband is 55 so it looks like we can keep $24,100 out and it not be a bad thing. That all helps me figure out what we can do and need to do. Thank you for the info!

Author

Hi Jennifer,

If you put money into tax-deferred retirement account, such as a 401k or a traditional IRA, you must declare those contributions on the FAFSA and PROFILE if you made the contributions in the base year. The base year for students in college in the fall of 2018 would be the year of 2016. So if you contributed to your 401k in 2016, that would be declared on your income tax return as untaxed income. Remember parents are now using two-year-old tax returns. The following year, you’d have to declare any money put into tax-deferred retirements accounts in 2017. You can contribute to Roth IRAs without adding the money back into the FAFSA because you don’t get a tax deduction on the front end.

Let’s say you put $10,000 in a 401(k) in 2017, that money would have to be declared as untaxed income on the FAFSA and the PROFILE for the 2019-2020 school year.

Keep in mind that parent assets are assessed at a low rate – 5% or 5.64%. So if you had $10,000 in a nonretirement account, it would only decrease chances for financial by $564. Assets are usually not a big factor when it comes to qualifying for need-based aid.

Lynn O.

Hi Lynn- Do you know if trust equity is treated differently than “other real estate equity”? We have properties in a trust & I don’t know whether to include them in property equity or wait until one of the CSSProfile schools asks about trust equity (which only some do).

Hi Lynn,

I am thinking of funding 18K in a Roth 403(b) employer provided progarm. Since this money does not come out pre-taxed, this would appear as income on my AGI I assume. I am wondering it might be better to just do traditional 403(b)s (have the money come out pre-taxed), so my AGI appears lower when I do the FAFSA…Am I wrong, or it does not matter…?

Author

Hi Matthew,

This is a great question! You are right that you don’t get an upfront tax break for any Roth 403(b) contributions. Contributions that you make into a Roth 403b would be considered income on your financial applications.

However, if you contributed to a regular 403(b) or a 401(k) where the contributions are pretax the contributions would not be shielded from the financial aid calculations even though they would lower your AGI. Parents must share these pretax contributions on the financial aid forms as untaxed income. So don’t make a decision about whether to contribute to a regular 403b or a Roth 403b based on financial aid considerations since it doesn’t impact the aid numbers.

Lynn O.

Thanks so much!

Lynn, We hope to file our FAFSA/Profile soon for our senior (17 yrs) but don’t know what to do about our UTMA account ($4,700). If assessed at 20%, our aid will decrease and EFC increase by $940. (We qualify for 18 – 22K in aid w/o the UTMA.) Should we just let that $940 go? Or try and spend down the $4,700? Are we risking an IRS audit if we do?

Supposedly we can use these funds for test prep classes, college visits, and other costs FBO our child, but not sure it makes sense to purchase items (laptop, car) under duress. Also not sure if we can make claims retroactively (e.g., withdraw funds to cover a college visit this month).

I assume it’s too late to roll it into a custodial 529 plan?

Hi Melissa,

You could charge your child for things not directly related to putting food on the table and a roof over his head. You could charge him for the college trip that you took and then just transfer the money to your account for his college bills. I would not buy him something just to lower your EFC! Keep in mind that just because you would be eligible for more need-based aid doesn’t mean you would get it. You could just get more loans by having your EFC drop.

I’d think of whatever you could charge him for. How about gas money? His car insurance? Money you might give him for going to the movies or a restaurant? Money for prom? I bet you can think of things if you try.

If you roll the UTMA into a custodial 529 account, any capital gains would be declared as the child’s income. The FAFSA does allow a student to shield up to $6,400 in income this year without it hurting aid chances. Any income above that is assessed at 50%. Once in a custodial 529, the money will be assessed as the parent asset.

As for the PROFILE, many PROFILE schools will not assess a custodial 529 account as a parent’s asset. You would have to contact individual schools to see how it’s treated.

.

Your tax preparer is obviously wrong that UTMA money has to be spent just on educational expenses.

Lynn O’Shaughnessy

Lynn,

Never mind, I figured it out.

Thanks

Lynn,

Have a question, I have Coverdell acct setup for the benefit for my children, I understand it should be reported as my (parent) asset. However on the FASFA form, which filed should I use to report?

Should I use #91 Parent Net Worth of current Investment? or other field?

Thanks

Glad you figured this out. You are right that Coverdell accounts are treated as a parent asset. If you ever have any questions about the FAFSA after this class is over, you can call the FAFSA hotline. Here is the link: https://studentaidhelp.ed.gov/app/home/site/fafsa

Lynn O.

Hi Lynn,

My husband makes approximately $100K/year but approximately $20K is taken out pretax, much of it for his 403B, so on our federal tax returns his income is $80K.

In Ways to Maximize a Financial Aid Package, this caught my eye:

Here is something, however, that aggressive retirement savers need to keep in mind:

Hi,

I received this question from a mom in the class. I wanted to share it because it can help others.

If you receive a tax deduction for contributing to a retirement plan, such as a 401(k) or a traditional IRA, two years prior to year your child heading to college (prior-prior tax year) and every subsequent year that you file for aid, the financial aid formula will adjust your income upward. The formulas will add back to your income the contribution dollars to you or a spouse’s retirement plan, but this money will no longer be considered an asset for financial aid purposes. This money is considered the parent’s untaxed income.

Questions:

1) When I completed the EFC calculator, I used $80K as his “earnings from work”. Is that correct?

2) I didn’t realize that “Untaxed income/benefits” probably refers to his sheltered $20K. Is that accurate?

3) I am astounded by the result of the EFC for our family of four. We live in CA with an AGI of $166K. I have always been a saver and we have non retirement investments of approximately $450K, including 529s. THE EFC calculator shows that our contribution is approx. $60K for child #1. That is more than 1/3 of our AGI! Should we truly contribute

$60K per year x 4 years that would wipe out more than half of our savings. As we have two kids, at that rate, college would wipe out all of our non retirement savings. Does that surprise you? Did I really figure this out correctly?! This is not a rhetorical question…. looking forward to your response.

Here is my answer:

You are correct. When you make a contribution to a retirement account where you get an upfront tax break, the sheltered income is added back for financial aid calculations. In future years, however, this money will not be counted against you for financial aid purposes because it is in a retirement account. This doesn’t happen with a Roth because you don’t get a deduction.

Having $450,000 in non retirement money will hurt chance for need-based financial aid. This amount would lower your chances for need-based financial aid by up to $22,500 for a PROFILE school. Actually, however, it wouldn’t be that much because the PROFILE shelters some taxable money. The FAFSA assesses these taxable assets a bit higher at no more than 5.64%.

It would be possible for your EFC to be that high if you included home equity. I ran the numbers with $450,000 in non-retirement assets, AGI of $160,000, $25,000 paid in taxes, but I didn’t include home equity. I came out with a $46,228 EFC for the institutional methodology and $57,536 for the federal. The institutional formula shelters more non-retirement assets than the FAFSA which should explain a lot or all of the discrepancy.

Considering your situation, it would behoove you to look for schools that give out healthy merit scholarships. The good news is that the vast majority of schools provide merit scholarships.

And, by the way, congratulations on being such great savers. You are going to be in better shape than people who qualify for need-based aid, but haven’t saved. Rarely does financial aid provide what a family really needs.

At the end of the day, it doesn’t matter if the discounts are characterized as merit scholarships or need-based aid, what matters is the price you pay!

Lynn O.

Hi Lynn:

I have Educational Savings accounts for both my sons. One is a senior and I am filling out the FAFSA as we speak. The other is in 10th grade. Do I report this account under my assets? Do I have to report the amount in my 10th grader’s account as well? They are two separate accounts, both Educational Savings Accounts through Charles Schwab.

Thanks,

Laura

Hi Laura,

I assume the account you are talking about is either a 529 account or a Coverdell account. Either way, you would report these assets as the parent assets. You would also report your younger child’s 529/Coverdell on your older child’s FAFSA.

Lynn O.

hello lynn,

i have a questions regarding savings funds. we are in mass. and i would like to start a fund for our 8th grader. i know the mefa has a mass ufund but would you suggest other out of state college funds options to look at. what is the best directions since we are starting so late for her.

my other daughter has a small fund from her grandmother collgeadvantage by blackrock. we are also contributing monthly payments into it. would it make sense to open a similar account for our younger daughter or just stick with mefa ufunds?

thank you,

jana

Hi Jana,

I am not a financial advisor so I can’t recommend what you should specifically do to save for college. I would look at the tax break you would get from the Massachusetts plan (I’m assuming you are a resident) and look at the expenses you pay in the plan before deciding. You won’t be able to invest aggressively at this point so the returns aren’t probably going to vary much from plan to plan. What I can recommend is to save as much as possible for your child’s education. The more you save, the more options you will have.

Lynn O.

Hi Lynn. My son has a UTMA account with $3500 for which I am a custodian. He cannot access it until he is 18. My husband and my combined income excludes us from qualifying for need based aid. However, my son will most likely qualify for merit based aid. I am wondering if it is worth it for me to transfer the UTMA to a 529 as you recommended above in order for him to qualify for higher merit scholarships? Do merit based awards take into account income and assets at all?

Thanks!

Laura

Hi Laura,

Do not worry about the UTMA account. Money in an UTMA account is irrelevant when schools determine if a child is going to get merit aid. Merit scholarships are not at all linked to need-based aid.

Lynn O’Shaughnessy

Hi Lynn:

Thank you for your answer. In regards to the UTMA account on the FAFSA, do I report it under my son’s assets or mine?

The UTMA account should be reported as your son’s asset.

Lynn O

Lynn, the link to the Kantrowitz article is broken, but I found the article at https://www.edvisors.com/blog/asset-protection-allowance-plummets-08-2015/ .

Thanks Paula! Missing links are such a moving target. I’ve fixed the link thanks to you.

Lynn O.

The link “529 Plans: Why You Should Invest for Just 24 Hours” was written in 2010. Does the loop hole still exist? Colorado appears to do a tax deduction for the full amount of the contribution. Do I understand this right? If a Colorado family puts in the tuition (say $20,000) into a 529 before doing their taxes for the year in March, their income will be taxed at $20,000 less for that year’s taxes? That same family could them withdraw that money in August (if there is no hold) to pay for college. Where do I find what Colorado’s hold could be?

Hi Lauran,

The story is old (that’s the only time I’ve ever written about this), but the strategy is still valid.

I don’t know what Colorado’s policy is, but I assume it would offer a tax deduction. You should contact the 529 provider in your state. If it’s the direct plan then Vanguard manages it. Here is a link via SavingforCollege.com: http://www.savingforcollege.com/529_plan_details/index.php?state_id=6&page=plans_by_state

Lynn O.

I just had a parent of twins seniors drop out of the sky with a mess of a situation. Not only has one of the kids applied to a string of Ivies, but the parents have already missed deadlines at some of their schools. They were waiting for their accountant to finish their taxes as this year’s income is FAR LESS than last year’s.

AGI this year was $48,700. They expect it will be even less next year. Parents are 65 and 69, and father is taking social security.

Rub is that they have sizeable investments — no mortgage on family home, second rental property (that hasn’t been rented in over a year), 529s, savings accounts set up since birth for each for the kids (in the children’s names).

Mom is wanting to know if she should make maximum contributions to their retirement savings before filing tax return. They could make a $13,000 contribution to their IRA’s — bringing their AGI to $35,000.

Is there any point in doing this? Is there a magic AGI that would limit looks at their assets?

Hi Diane,

Thanks for your question.

The mom wants to know if making the maximum IRA contributions would increase her child’s eligibility for financial aid. No it would not. When you make a pre-tax contribution to an IRA, 401(k) or other qualified retirement account that provides an upfront tax deduction in a base year (this refers to the year the aid formula is examining), the contribution, in this case $13,000, would be added back into their income.

The good news is that once this money is in a retirement account it would never hurt eligibility for financial aid again.

I should mention that if the family had applied to a FAFSA-only school, they might have been able to avoid sharing their considerable assets. The FAFSA allows families to avoid revealing assets when their adjusted gross income is under $50,000 and they can file the 1040A or 1040EZ. PROFILE schools, however, will ask about assets regardless of income.

Here is an explanation about the FAFSA Simplified Needs Test.

https://www.edvisors.com/fafsa/eligibility/simplified-needs-test/

Lynn O’Shaughnessy

Lynn

In regards to the 529 plans. My in-laws have set up a 529 plan for each of my three chilren that has my wife as the holder of the account. When we get the statements it itemizes the total amount of the plan by each of the three children. When we go through the financial aid process do we factor in the total amount of the plan or just the amount for my oldest child who will be attending college.first?

Tom

Hi Thomas,

You will share the total amount of money that you have in 529 accounts. This money is considered the parent’s asset and is assessed accordingly. If parents were allowed to just mention the 529 money for the child heading to college, parents could transfer this 529 money to their other children. At least that’s what I think the reasoning is for why all the 529 money needs to be reported.

Lynn O.

Lynn, regarding the question on ‘other’ real estate investments (not primary home) on the FAFSA and EFC, would a lot with no building qualify (meaning it should be included)? I am not sure whether this refers to only revenue-generating real estate/rental properties, or if it includes a building lot which would not generate revenue.

Hi Valerie,

Yes, any kind of property – beyond the primary home – needs to be included on the FAFSA and the PROFILE. It doesn’t matter if it doesn’t produce revenue.

Lynn O’Shaughnessy

Hi Lynn,

Before my dad passed away, he set up UGMA accounts for both of my daughters. After he died, I legally transferred the custodianship of both of those accounts to myself, and also moved the assets into 529 plans at Vanguard. For reasons I can’t quite recall, I had to keep these accounts as UGMAs — and so now they are “UGMA 529” accounts, with me listed as the custodian. I understand that UGMAs will be classified as the child’s asset, but that 529s will be classified as the parent’s asset … but what if, as in our case, they are both 529s and UGMAs? Would they be listed as a parental asset, or a child’s asset?

Hi Rebecca,

You are in luck. The UGMA 529, also known as custodial assets, belong to the child, but the financial aid formulas treat these special 529 accounts as if they belonged to the parent. So the PROFILE will assess the UGMA 529 accounts at 5% and the federal formula will assess them at a maximum of 5.64%.

Lynn O.

Hi Lynn,

My husband would like to purchase some stock (~$2K/kid) for our kids (15 & 13 y.o.) to teach them about investments. Is it better to NOT put assets in their name?

Also, we have equity in rental property and our kids are ~3.8 GPA students. Will we be able to get merit aid? If not, is there any reason to fill out FAFSA?

Thanks,

Diana

Hi Diana,

It would be better to not put stock in your children’s name if there is a chance of obtaining need-based aid down the road. As a financial journalist, I would recommend teaching your children about the value of investing in index funds. The risk associated with individual stocks isn’t compensated by the potential rewards. Just my opinion, of course, but this is the view of many financial journalists who overwhelmingly invest in index funds (at least the ones I know)! And the most popular will be from the Vanguard Group.

I would suggest you run the EFC calculator to see what your potential EFC is. There are many factors involved in creating an EFC including income and assets.

Your children would definitely qualify for merit scholarships at many colleges and universities. Keep in mind that nearly 89% of students at private colleges/universities get tuition discounts. You can be a B or C student and still not pay full price at plenty of schools.

Lynn O’Shaughnessy

Hi Lynn,

Many thanks for the teaching advice. I’ll pass it along to my husband.

What prompted me to ask about the real estate equity was that when I ran the EFC calculator I got a reasonable number for Federal Methodology and super high number for Institutional Methodology. I assumed that this was because of the rental property but maybe it’s because of home equity, too.

Do state colleges/universities also offer discounts to B students? For us it will be out-of-state since we live in CA. I’ve learned from you that CA does not give discounts.

— Diana

Hi Diana,

The high number for the institutional methodology can probably be explained by the equity in your home and your rental properties. You can figure this out taking out the home equity and running the EFC. And then take out the rental equity and run it again.

There are many, many colleges that offer discounts to B students. For state schools, I’d start looking at the Western Undergraduate Exchange (WUE) that offers discounts to some students. The requirements will vary by school. At U of New Mexico, you can have a 3.0 GPA and get a fat scholarship. My favorite WUE school is Western Washington U. I’ve heard great feedback from U of Montana. There are other values out there. For example, U. of Minnesota has a lower price than many flagships and the SUNYs in New York (there is no one flagship) can be a good value. As for private schools, keep in mind that nearly 89% of private colleges and universities offer tuition discounts to student. That means the vast majority of schools offer discounts to almost everyone. Private schools off the coast will be less expensive. As an example, the College of Idaho gives money to 98% of students and that’s normal for many liberal arts colleges including my son’s and daughter’s (Beloit and Junita.) Hendrix, a wonderful liberal arts college in Arkansas (and per capita a large producer of undergrads who ultimately receive PhDs in science of engineering ) gives 100% of students money. The average merit aid is more than $26,000! College of Wooster, a favorite of mine, 99% of students get money. There are tons of example of this if you generally stay off the coasts.

Lynn O’Shaughnessy

P.S. The two links — one about investing in 529’s for 24 hours, and the summer job one, didn’t work for me just now.

Hi David,

I just checked both links and they worked for me. They are both links to a couple of posts I wrote for CBS MoneyWatch. Perhaps you should try again with a different browser.

Lynn O.

Thanks — they both worked this time.

She hasn’t received her financial aid offer letter yet, so I don’t know if she’s getting need-based aid. I did get an e-mail that they were only allowed to discuss my appeal with my daughter because of privacy considerations. So at least I know they received it, but I haven’t heard if they e-mailed my daughter yet.

Hi David,

That seems very strange that they would refuse to talk to you about the aid offer!

I did hear back from my friend, Paula Bishop, the CPA and financial aid expert, about your question regarding your daughter’s future settlement. Here is what she had to say:

I would just regard the legal settlement as a reserve for future possible surgeries (assuming she got hurt), and not even put it on the FAFSA. In 2002, I got hit by a car as a pedestrian and the attorney was successful in obtaining a $50K settlement to me, and I did not report it as an asset. I was told I would most likely have arthritis early due to the injury to my wrist (I had several surgeries). I know the wording of a settlement could be tricky, but if a college ever finds out about it and asks some question (which I doubt they would even know about), then he could explain it was a settlement for possible future medical issues. This is quite common with settlements.

Lynn O.

I just left a question about the FAFSA, and then read the Edvisors book which gave an answer — if we file by paper with the IRS we have to wait 6-8 weeks to use the IRS Date Retrieval tool. But I do have another question: My daughter currently at a community college and planning to transfer to a state university (the Univ. of Idaho in Moscow) may be receiving a significant accident settlement. What’s the best way to invest the money to not count against future financial aid eligibility – she’d like to have it available for a down payment on a house?

One suggestion – delay the settlement as long as possible. The FAFSA wants to know how much she has in assets on the day she files the FAFSA. If she hasn’t received the settlement, there is nothing to report.

One thing you should consider is whether you would even qualify for need-based aid at the University of Idaho. The tuition is currently under $6,800 and the room/board is $8,450. If she wouldn’t qualify for need-based aid based on you and your wife’s income/assets then what she gets in a settlement wouldn’t matter.

Some people might suggest putting her money in an annuity since FAFSA schools, unlike PROFILE schools, don’t ask about annuities. Most annuities, however, are very expensive with commissions and ongoing fees and withdrawal penalties. You really need to think about the cost of potentially hiding her money. If you do look at annuities, I’d suggest seeing what you can find via the Vanguard Group.

Lynn O.

We have filed her FAFSA already, and she hasn’t received the settlement yet, so we’re clear there. I was thinking about next year. As I recall, the FAFSA doesn’t ask about whether the student owns a home do they? Would it make sense for her to buy a mobile home to live in while she’s at the University of Idaho? Would there be potential issue if she sells it before going to grad school?

I forgot to say, based on our FAFSA, she qualifies for $780 Pell Grant this year. Thanks to your advice, I have just sent their Financial Aid office a letter appealing for further consideration because I got an inheiritance which allowed me to put $22,900 into my 403b retirement fund which I’m not going to be doing this next year.

Hi David,

Appealing the award based on that one-time windfall was a good idea.

Lynn O.

Hi David,

You are right that the FAFSA doesn’t ask about a primary home, but I don’t know if that would work since she is a dependent. I don’t know if a mobile home could be considered her primary residence under the circumstances. I’ll look into this and get back to you.

As for graduate school, I wouldn’t worry. The federal aid for graduate students are loans. An exception are TEACH grants for future teachers and financial need is irrelevant. Money from schools typically come from academic departments and are given out as merit awards.

Lynn O.

One other thought on this David. Since your daughter is getting such a tiny Pell Grant, I wonder about the wisdom of hiding her settlement into something that would be difficult to retrieve and expensive (annuities) or starts depreciating as soon as its bought (mobile home). Is she getting need-based aid from the state that would be endangered too?

Lynn O.