As I’ve been discussing in this class, many college financial aid letters are confusing and misleading.

Recognizing this reality, the federal government created a template for a model financial aid letter called the Shopping Sheet. If your child or client received a financial aid award that uses the Shopping Sheet, it will be far easier to understand whether a school is being generous, stingy or somewhere in between.

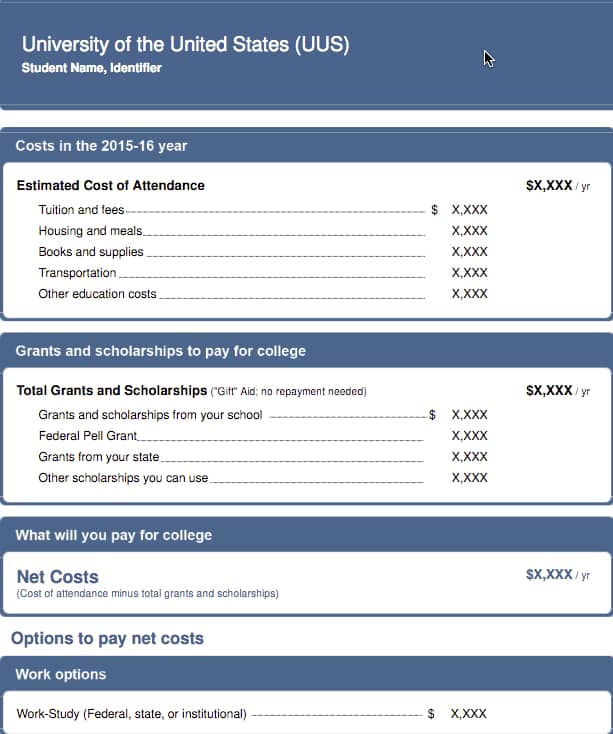

Financial Aid Shopping Sheet

Nearly 69% of schools in the nation are using the federal Shopping Sheet. Here is what the Federal Shopping Sheet template looks like:

The Shopping Sheet Features

Unlike most financial aid awards, the Shopping Sheet does not mix loans with scholarships and grants. The award letter lets you know what your true net cost will be by subtracting just the free money from the total cost of attendance. All awards letters should be doing this, but most don’t.

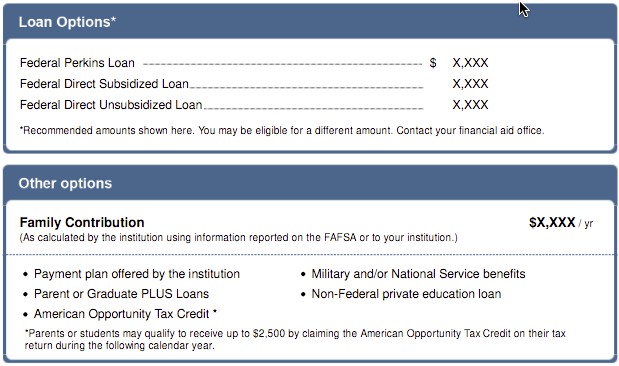

Below the net price on this template, you will see federal student loan options and work-study. The document also mentions other ways to pay such as borrowing through PLUS Loans for parents and private college loans.

You will also see your family contribution, which is extremely important. It would have been better if the Shopping Sheet would have used the term Expected Family Contribution (EFC) instead.

Your EFC, which is determined by financial aid methodologies, is what you would be expected to pay, at a minimum, for one year of school. With a low EFC, the school should ideally give the student a higher amount of aid. If the school doesn’t, then he or she is gapped.

Without knowing your EFC, you won’t be able to determine if the award is a good one or not. Colleges, however, typically do not provide a family’s EFC on their award letters. If you don’t see it on your child’s award letter, ask the school for the figure.

Other Features of the Shopping Sheet

The federal government’s model financial aid letter also includes the graduation rate of the institution and compares it to its peers. It’s frustrating, however, that the form only includes the six-year rate. The four and five-year rates should be included too.

It’s also helpful to share what the average student is borrowing to attend this school. Keep in mind, however, that this doesn’t include parent borrowing.

Schools Using the Shopping Sheet

You can see the institutions that do use the Shopping Sheet by clicking on this latest Shopping Sheet list. (It was updated as of October 2015.These schools and others that have decided to simplify their financial aid forms should be applauded. Let’s hope more institutions join these schools for the next admission season!

Analyzing Aid Letters With College Abacus

College Abacus is another great resource that can help you turn any aid letter into an easy-to-understand document that can be compared to other awards. (You will have to register on College Abacus to use the award-comparison tool.) College Abacus does this by using the Shopping Sheet model. College Abacus directs parents to plug in figures that they can find within a financial-aid letter. In the following screen capture, you will see how I inputted estimated cost figures and a hypothetical award from Chapman University in Southern California.

In this example, I assumed that the teenager earned a $14,600 merit scholarship. To create this example, I used Chapman’s tuition/fees and housing/meals prices.

After College Abacus subtracted free money from the school’s sticker price (in the above example, the student didn’t qualify for federal or state assistance), the net price was $43,273 for the year. As you’ve learned already, many schools mask the net cost by excluding or minimizing the cost of attendance in the letter or by treating loans as it they were the same as grants and scholarships.

As noted earlier, many schools do not include the EFC in a student’s award letter. Schools like to avoid sharing a family’s EFC because it would make it obvious if a school is gapping the applicant. That is the gap between a school’s net cost and the EFC.

Comparing Aid Letters With College Abacus

Once you’ve inputted the figures from all your financial aid letters, College Abacus allows you to compare awards simultaneously. That’s what I’ve done with the four schools you see below.

Bottom Line:

While schools will continue to resist providing students with easy-to-understand financial aid letters, families can decipher confusing and misleading aid letters by relying on the Shopping Sheet and College Abacus.

College abacus has a .org instead of a .com. The link as is does not work.

Thanks Michele for alerting me! Since I wrote this lesson College Abacus has gone from being a for-profit business to a nonprofit which prompted the new URL.

Lynn O.