Colleges are beginning to realize that high tuition/high discount (scholarship) model is failing.

Escalating tuition is leaving more students unable to cover college costs even as colleges continue to offer scholarships to offset costs. In my last post, I mentioned the latest drive by private colleges to rein in merit money, but, as one of the visitors to my blog noted this week, there doesn’t seem to be talk about putting the brakes on escalating tuition.

If you missed my last two posts on this subject, here they are:

Another Look at Merit Scholarships

What’s Behind Rising Prices

The prospects for reigning in tuition don’t seem great. One reason is because the trendsetters are elite institutions such as the Ivy League schools and the top liberal arts colleges, which can raise their tuition without scaring away applicants. This is possible because the overwhelming number of students at these outrageously expensive schools are rich.

Other schools, farther down on the pecking order, aspire to attract the same kind of students and enjoy the same kind of ratings so they try to offer the same kind of amenities that the alpha dogs can provide.

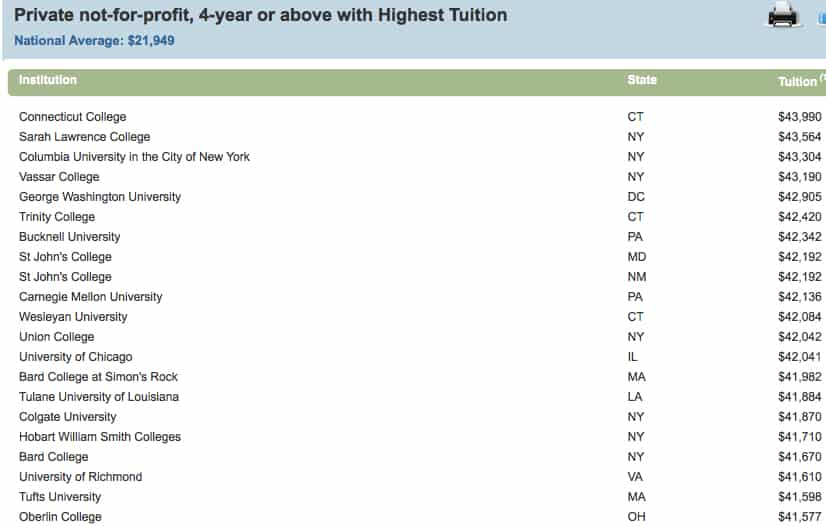

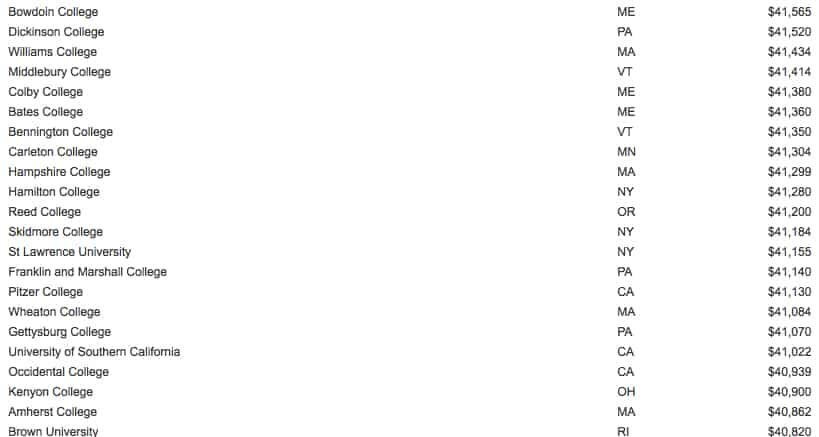

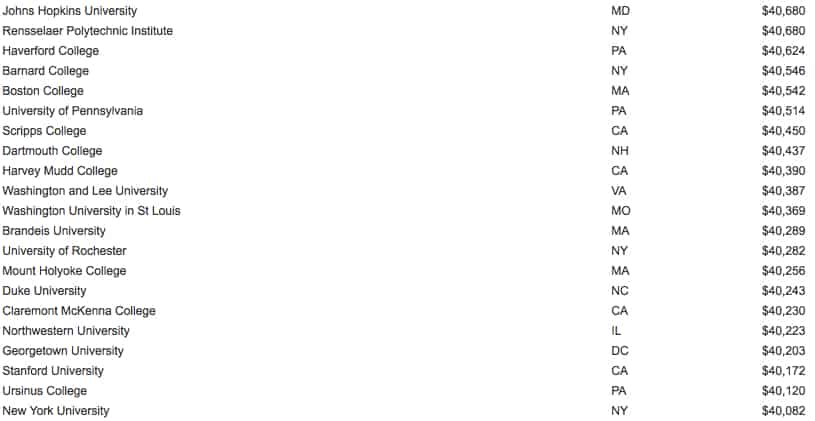

As you can see from the chart below nearly all the tuition hogs are on the East and West Coast. The federal government compiles this annual hall of shame list of schools that represents the top 5% of colleges and universities in the nation with the highest tuition. The federal government hoped that by spotlighting the biggest tuition offenders (state schools have their own list) that schools might change their behavior.

On this list, I only spotted nine schools that aren’t on the West or East Coast.

Will It Ever Happen?

Until these schools get serious about escalating price tags, the prices for all private institutions will continue to climb. Some weaker private schools will probablyl end up closing as families balk at paying these prices.

If you’d like to see the other lists (including the most expensive state and private schools by net price), head to the the federal College Affordability and Transparency Center.

Net Price Calculators make it pretty easy to figure out what the discount rate will be at these tuition hogs, as you call them. True, they are expensive if you earn a lot.

I earn $100,000 a year, and with one other child in college, the Net Price Calculators are showing me prices in the range of $14,000 to $22,000 (before any loans or work-study) at schools such as Connecticut College, Middlebury, Bucknell, Lafayette, Colgate, and Boston College. Princeton, where my child won’t get in, would cost only $7,500, a sum she could cover herself between loans, work-study and a summer job. The problem with the rich, prestige schools is that they are difficult to get into, not that they are unaffordable.

$60,000 seems to me to be an absurd price for a year in college. The big-name schools only charge those rates to those who can afford them. The other private schools have entered the arms race, but do they really have to? They still will lose students to the elite schools, anyway. Rather than blame the leaders, blame the followers.

our Bucknell numbers: total cost for 2012/13: $59,900. With military Post 9-11/GI Bill benefits and associated housing allowance, our yearly portion would be @ $13,500. Just read a 10Feb2013 New York Times article, “Battling College Costs, a Paycheck at a Time”, that lists the average yearly debt for public universities is $13,600. Is there a published average for private universities?

Hi Amy,

Good to hear from you! That sounds like a great deal with Bucknell. The average student loan debt, private and public combined, is about $26,000. About two thirds of students borrow for college. Here is the press release from The Project on Student Debt about the latest debt figures: http://projectonstudentdebt.org/pub_view.php?idx=865

Lynn O’Shaughnessy

Thanks, Lynn. I learn something new every time I read your blog!! I should have added in my post that my son was in that magic top 33% of Bucknell applicants. He received “Yellow Ribbon” money from the school, which is sometimes offered to GI Bill users. The Yellow Ribbon money probably approximated the same amount he would have received in Merit Scholarship money (which isn’t given to Post 9-11/GI Bill users at Bucknell). Without the GI Bill, Bucknell would have been way out of our league.

It would be really interesting to see the discount rate of these institutions, then we would see the real cost.

How many of these colleges actually charge anyone full price? I have done a lot of research on the University of Chicago. On their website, they state, “The average University of Chicago aid applicant receives $37,500 in scholarships each year.” The Financial Aid office had a budget of $93.8 Million to disperse for student aid for the 2012-2013 school year. 59% of financial aid applicants with family incomes above $120,000 received aid. 93% of those with incomes up to $120,000 received aid. I ran various scenarios through their net price calculator and even a family with a $200,000 income would not pay full price as long as they went through the financial aid application process. There is also a special program, thanks to a very generous donor, that replaces all federal loans with grants for families with incomes less than $75,000. Their children can attend entirely debt free.

With an aid culture like this, there aren’t enough families who would mind if the school keeps raising tuition. The site indicates two-thirds of their students are graduating debt free. These are the ones with family incomes either too high to even need financial aid or low enough that their education is almost completely subsidized by the school. It is only the other third in the middle, what we could probably term “upper middle-class,” who are getting squeezed because they can’t demonstrate enough need on their FAFSA and CSS Profile.

You can check out all the University of Chicago statistics at https://collegeadmissions.uchicago.edu/costs/affording_education.shtml.