Many families worry that their college savings accounts will kill their chances for financial aid.

It’s been my experience that it’s usually dads who get stressed out about how colleges will treat their college accounts for financial aid purposes. Some fathers whom I’ve talked are down right bitter. They are especially incensed at the possibility that families that didn’t set aside money for college will hog all the aid.

If that’s what you’re worried about, here’s my advice: Relax! Families who save for college are rarely hurt in student financial aid considerations.

Why Your Savings Won’t Hurt Financial Aid Chances

Here are the two biggest reasons why saving money shouldn’t hurt your financial aid chances:

1. Colleges don’t care how much you saved for retirement.

The Free Application for Federal Student Aid (FAFSA), which anyone applying for financial aid will complete, doesn’t even inquire about retirement accounts. Private colleges that use the CSS/Financial Aid PROFILE, will inquire about a family’s retirement accounts, but they won’t penalize parents for these assets.

2. Parents can also shelter plenty of money outside of retirement accounts.

It might not seem like it, but colleges don’t want to strip you of all of your available cash. The financial aid formulas will also let you shield a big chunk of your non-retirement money through an asset protection allowance.

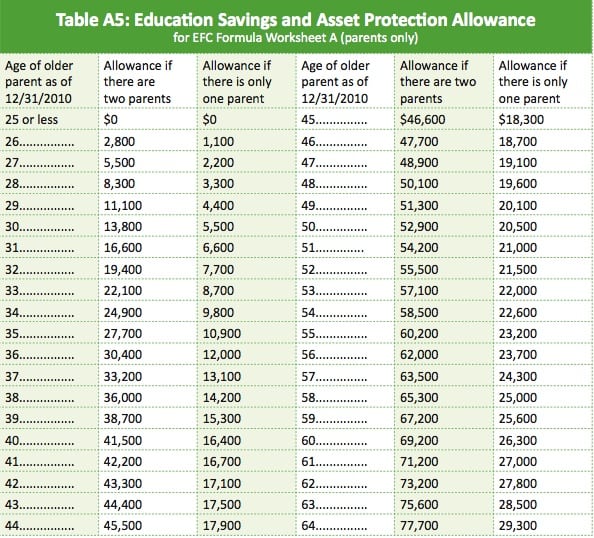

As you can see from the federal chart below, how much you can shield from the FAFSA formula depends on the age of the oldest parent. The closer the parent is to retirement age, the greater the amount he/she can shield from the financial aid formula.

Let’s say the oldest parent is 52. The family would be able to shield $55,500 in 529 savings plan money, as well as any other cash laying around in taxable accounts such as savings, checking and brokerage accounts. In a two-parent household, a 60-year-old parent could shelter $69,200 from financial aid calculations.

The amount a mom or dad could shelter in a one-parent household is significantly less. A 52-year-old single parent, for instance, could shelter $21,500.

Asset Allowance Illustration

Using an example should make it easier to see how this allowance would work. Let’s assume that a family has $100,000 in non-retirement assets, including $25,000 in a 529 savings plan, and the oldest parent is 55.

The family would get to shield $60,200 from the FAFSA formula, which would leave $39,800 unprotected. In calculating the family’s financial need, the FAFSA methodology wouldn’t expect the parents to sink all of that money into college. Consequently, the $39,800 in assets would be assessed at a parental rate of 5.46%. When you do the math, the child’s eligibility for need-based aid would only drop by $2,173 even though the family had $100,000 in the bank.

Knowing this, would you rather be a family who saved nothing for college or the family who has $100,000 in the bank? Obviously, it’s always better to save money, whether it’s for college or retirement. Do so and you’ll enjoy more options.

Lynn O’Shaughnessy is the author of The College Solution and She also writes a college blog for CBSMoneyWatch and US News. Follow her on Twitter.

Read more on The College Solution:

How Hard Is It To Get Into College?

Qualifying for Financial Aid: How Wealthy Is Too Wealthy?

Great information. Thank you for this very informative and timely post.

Glad you found the post helpful Kate.

Lynn O’Shaughnessy