Before you let your teenager apply to colleges, you need to use each college’s net price calculator.

Unless money is no object and you can afford to pay full price for any colleges, turning to net price calculators is critical.

If you don’t know what these calculators are – and most parents don’t – here are 10 things you need to know about this valuable tool:

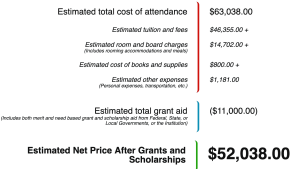

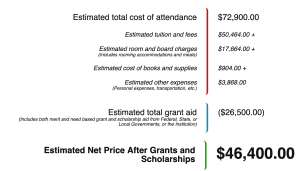

1. These calculators provide a family’s net price.

The net price represents what a student will have to pay after scholarships and grants from the federal and state governments and the school itself are subtracted.

Let’s say, for example, that a college costs $50,000 and the student will receive a $20,000 award from the school and a state grant of $5,000. The net price for this student would be $25,000.

The net price equals the true price of the college because it only considers free money and disregards loans when calculating the cost of a school.

You can see just how many different prices you can generate when using net price calculators by reading about the experience of a mother in Washington State. I wrote the following post several years ago, but it’s still highly relevant:

Case Study: What 66 Schools Would Cost This Family

2. Use net price calculators to test academic scenarios.

You should turn to these calculators to get a handle on what sort of applicants capture the best awards at an institution. What kind of grade point averages or test scores does it take for a student to win a greater award from a specific school?

With this tool, you can manipulate the figures to see whether it would be worth it for your child, for instance, to take the SAT or ACT again. Would a higher test score boost your child’s potential package? Would a slightly higher GPA matter?

With so much money at stake, it’s worth taking the time to use these calculators strategically.

3. Use net price calculators to weigh impact of home equity.

Net price calculators can also be handy when you want to figure out how a school treats home equity for  financial aid purposes.

financial aid purposes.

The vast majority of colleges and universities do not consider equity in a primary home, but many schools (nearly all private) that use the CSS Profile financial aid form do consider home equity. How the roughly 200 colleges treat home equity will vary.

4. Calculators will vary in what information they require.

To use many calculators, and particularly those of selective private schools, you will need your tax return and bank/investment statements. If your child has income and a bank account, you should gather that information too.

If the school provides merit scholarships, in addition to providing need-based aid, a good calculator will ask for additional information such as a teenager’s GPA, test scores, class rank, and activities.

A thorough calculator could take you 10 to 15 minutes to complete.

5. Some net price calculators are inaccurate.

The weakest calculators rely on a federal template. Using a calculator that relies on the federal template could take 30 seconds or less to complete!

The questions are minimal, which leads to dubious cost estimates.

These federal calculators are only meant to provide personalized cost estimates — faulty or not — to families seeking need-based aid. And even then, the need-based aid answers are simply averages.

A University of Pennsylvania report in 2019 determined that more than 50% of public universities and less than 25% of private institutions use the federal template.

6. The net price calculators using the federal template are worthless for families not seeking need-based aid.

These federally-based calculators will be absolutely worthless for wealthier families strictly seeking merit scholarships. The schools using the federal template ask only two or three questions if the family isn’t seeking need-based aid.

Here are the two questions that I answered when I tried out American University’s net price calculator in February 2020:

How could this university provide an accurate net price when all it knows about an applicant is his/her age and the decision not to apply for need-based aid!

Based on the answers to these two questions, I received this net price estimate from American University’s net price calculator:

7. The federal template asks inadequate questions for those seeking financial aid.

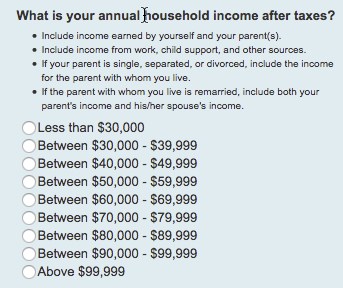

These federal calculators don’t ask for actual income and they ignore assets! These calculators just ask parents to pick an income range. The highest income level is just “Above $99,000.”

Besides American University, some more prominent private institutions that rely on the federal inspired calculators include:

- Bennington College

- Berklee College of Music

- Duquesne University

- New York University

Why would schools use a mediocre calculator? Here are two potential reasons:

Creating an accurate calculator isn’t a priority for some schools, which may also believe that applicants aren’t interested in them.

Private schools can favor mediocre calculators because the tools can mask the true cost of their schools. Admission officers may advise applicants to ignore worrisome calculator results and apply anyway because the calculator results are unreliable.

8. Look to see that the costs are up-to-date.

When using calculators check to see if the prices are current.

Unfortunately, schools that use the federal template will be using cost-of-attendance figures that are at least two years old.

In the below example, NYU is using 2017-2018 figures when I checked today even though high school seniors would be looking at the price for the 2021-2022 school year!

9. Net price estimates are not guarantees.

10. Where you can find net price calculators.

Schools are federally obligated to post their net price calculator for freshmen on their website. It can be hard, however, finding these calculators.

An easy way to look for a school’s calculator is to Google the name of the institution and net price calculator.

Learn more:

It’s 2020 and college prices have never been higher.

You can, however, discover how to slash college costs by enrolling in my online course, The College Cost Lab