If your child is in the midst of applying to colleges, do you have an excellent idea of what each school on your child’s list will cost you? If you don’t, I strongly suggest that you temporarily halt the admission process and find out.

Traditionally, parents couldn’t know what any college was going to cost until their child received his or her financial aid or merit award package. Sometimes this financial news doesn’t arrive until the spring, which gives families ridiculously little time to select a school by the deposit deadline, which is often May 1.

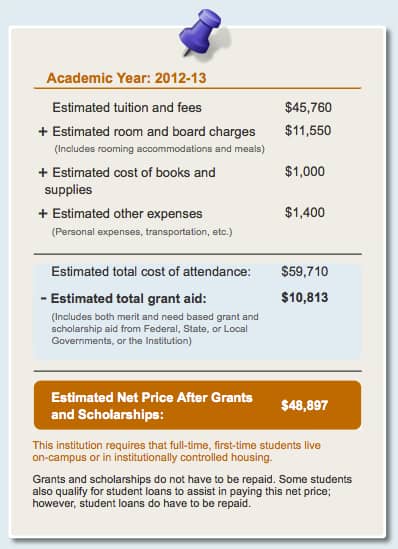

Applying to schools, however, no longer needs to be a financial crapshoot if you use a tool called a net price calculator before your child applies to any colleges. By using a net price calculator, you will discover what a particular school will cost your family once any merit scholarships and/or need-based aid that he or she would qualify for is subtracted from the official cost of attendance.

When using a calculator, some families will discover that the cost of a $60,000 university will be $30,000 or $20,000 or even lower. For other families, the cost really will be $60,000.

Learn What You’ll Pay Before Applying

If you want to avoid budget-busting schools, it’s critical to know what the actual prices of particular schools will be before your child falls in love with them. In fact, turning to net price calculators could ultimately save you tens of thousands of dollars by focusing your efforts on schools that will be more generous to your family. Unless you are wealthy and the cost is irrelevant, I would argue that you shouldn’t let your child apply to schools that are way beyond your ability to pay.

Every college and university that participates in the federal financial aid system, and that’s almost all of them, must post a net price calculator on its website for freshman applicants. Some schools also provide a calculator for transfer students.

The Inside Scoop on Net Price Calculators

To squeeze the most value out of these calculators, here are 10 things you need to know about using them:

1. These calculators provide a family’s net price.

The net price represents what a student will have to pay after scholarships and grants from the federal and state governments and the school itself are subtracted.

Let’s say, for example, that a college costs $50,000 and the student will receive a $30,000 award from the school and a state grant of $5,000. The net price for this student would be $15,000.

The net price equals the true price of the college because it only considers free money and disregards loans when calculating the cost of a school.

You can see just how many different prices you can generate when using net price calculators by reading about the experience of a mother in Washington State:

Case Study: What 66 Schools Would Cost This Family

2. Use net price calculators to test academic scenarios.

You should turn to these calculators to get a handle on what sort of applicants capture the best awards at an institution. What kind of grade point averages or test scores does it take for a student to win a greater award from a specific school?

To illustrate what we’re talking about, let’s look at the experience of a father whose son is a student at Northeastern University in Boston. When the dad initially used Northeastern U.’s net price calculator and plugged in his son’s SAT score of 1300 (out of 1600), the calculator estimated his grant at $20,000 for the first year.

After his son earned a 1340 score on the SAT, the dad retried the calculator and discovered that the teenager’s award had jumped to $34,200.

With this tool, you can manipulate the figures to see whether it would be worth it for your child, for instance, to take the SAT or ACT again. Would a higher test score boost your child’s potential package? Would a slightly higher GPA matter?

With so much money at stake, it’s worth taking the time to use these calculators strategically.

3. Use net price calculators to weigh impact of assets.

These calculators can also be handy when you want to figure out how a school treats assets, such as a small business, rental property, investments accounts, and home equity for  financial aid purposes.

financial aid purposes.

I wrote an eye-opening blog post (see link below) that illustrates how differently schools treat home equity. You learned earlier that private schools that use the PROFILE financial aid application can develop their own aid formulas to assess home equity. Schools that only use the FAFSA don’t ask about primary home ownership.

Will Your Home Equity Hurt Your Financial Aid Chances? A Case Study

In the blog post, I wrote about an unemployed New Jersey dad/engineer, who inadvertently discovered how two dozen institutions including Boston College, Dartmouth, Villanova, University of Rochester, Dickinson College, and Georgetown treated his home equity in significantly different ways that resulted in estimated awards that would have had the family pay anywhere from $0 to more than $40,000 for one year of college.

4. Calculators will vary in what information they require.

To use many calculators, and particularly those of selective private schools, you will need your latest tax return and bank/investment statements. If your child has income and a bank account, you should gather that information too.

If the school provides merit scholarships, in addition to providing need-based aid, a good calculator will ask for additional information such as a teenager’s GPA, test scores, class rank, and activities.

A thorough calculator could take you 10 to 15 minutes to complete.

5. Some net price calculators are inaccurate.

The weakest calculators rely on the federal-calculator template. Using a calculator that uses the federal template could take less than a minute to complete! The questions are minimal, which leads to dubious cost estimates.

These federal calculators are only meant to provide personalized cost estimates — faulty or not — to families seeking need-based aid. And even then, the need-based aid answers are simply averages.

The schools using the federal template ask only two questions if the family isn’t seeking need-based aid. Here are the two questions that I answered when I tried out Carnegie Mellon’s net price calculator:

How could this university provide an accurate net price when all it knows about some of students is his/her age and the decision not to apply for need-based aid!

Based on the answers to these two questions, I received this net price estimate from Carnegie Mellon’s net price calculator:

These federally-based calculators that Carnegie Mellon and others schools use will be absolutely worthless for wealthier families strictly seeking merit scholarships. These calculators will also often be inaccurate for students of households of any income because they do not ask questions that would determine if a child qualifies for a school’s merit scholarships.

Slightly more than 50% of schools use the federal-calculator model. Many of the schools using the federal template are state universities, but some private schools have embraced this inferior calculator too. Private institutions that rely on the federal inspired calculators include:

- American University

- Babson College

- Boston Conservatory

- Carnegie Mellon University

- Gonzaga University

- New York University

- Pepperdine University

You can’t expect to get a reliable financial-aid verdict from any school using the federal template.

Why would schools use a mediocre calculator? Here are two potential reasons:

Creating an accurate calculator isn’t a priority for some schools, which may also believe that applicants aren’t interested in them.

Private schools can favor mediocre calculators because the tools can mask the true cost of their schools. Admission officers may advise applicants to ignore worrisome calculator results and apply anyway because the calculator results are unreliable.

6. Observe how many questions a calculator asks.

Calculators that depend on the federal-template calculator ask few questions and don’t require the actual income that parents report on their income tax returns.

These federal-template calculators only provide income ranges and the highest income level the tool offers is “above $99,000.” (See below.) In addition, these calculators do not inquire about family assets!

7. Look to see that the costs are up-to-date.

When using calculators check to see if the prices are current.

When the Institute for College Success & Access did a survey of net price calculators in 2012, they discovered that 40% of schools were relying on old cost figures for their calculators with some going back as far as the 2008-2009 school year.

Unfortunately, schools that use the federal template will be using cost-of-attendance figures that are at least two years old. We’ve found schools sharing much older cost data.

As you can see below, Pepperdine University, a Christian institution in Malibu, CA, was still using 2011-2012 figures when I checked today!

8. Net price estimates are not guarantees.

9. Double-check your figures.

Be careful when inputting your information into a net price calculator. If the outcome seems wrong, try again. Ask a school’s financial aid office if you aren’t sure what information is needed.

10. Where you can find net price calculators.

Schools are federally obligated to post their net price calculator for freshmen on their website. It can be hard, however, finding these calculators. Some schools don’t want you to use them because you could discover how stingy they are.

An easy way to look for a school’s calculator is to Google the name of the institution and net price calculator. There is also a website that provides the link to many of these calculators – NetPriceCalculator.com.

Bottom Line:

- Use net price calculators before your child finalizes his/her college list. There is no point in letting your child get excited about particular schools if their costs will be exorbitant.

- Use these calculators strategically. See how assets and a child’s test scores/GPA could change awards.

- Ask a school how accurate its calculator is.

- Check how old each school’s cost figures are.

- Use the results of net price calculators to develop a list of schools that will be financially doable

Hi there! I was wondering if you have any suggestions/resources for a net-price-calculator tool that provides accurate estimates to families who own a small business. I was hoping to take advantage of the calculators on the webpages of the schools I plan to apply to, but some of them note that the calculations will be less accurate for small business owners – a caveat that applies to my family. Is it still helpful to use the provided calculators, or is there another tool that could provide more accurate estimates?

Thanks so much for your help!

I have not found any schools that take GPA and test scores into consideration to give you an idea of chances of merit-based aid. Is this something that is not done anymore???

Author

Hi Valerie,

If you are looking at the most elite schools, they usually don’t give merit scholarships so they wouldn’t calculate this or ask for academic stats. About half of the schools in the country use the lousy federal calculator and this calculator can’t determine merit aid. Nearly half of the calculators will.

Lynn O.

Lynn O.

I am confused on where you enter the SAT scores – when I go to your example school of Northeastern and enter data – no where does it ask for academic information. When the MY Net Price page come up It says “The estimated net cost does not include merit-based scholarships. Northeastern University offers several merit-based scholarship programs, ranging from $5,000 to full tuition annually.” Is there an additional step I am missing? Thanks

Hi Laura,

Unfortunately since I wrote this post Northeastern has changed its net price calculator so it’s not helpful any longer with merit scholarships. That’s extremely frustrating and not helpful to families!

Lynn O’Shaughnessy

We used the net price calculator linked on Oberlin College’s web site to get an estimate of how much it would cost for our son to attend after they contacted him. We were pleased to learn that their estimate was within our budget so we continued communicating with them and applied.

When we received the financial aid offer, we were disappointed to find that what they were offering was LESS THAN HALF of what the net price calculator had estimated. We appealed their award and, while they DID increase the award, it STILL fell nearly $12,000 short of the net price calculator estimate.

We returned to the net price calculator page to see if something had changed in the intervening period and we received the same estimate the second time through – AFTER having already received the actual award amount.

As promised, I’m checking back in with some more results. My child just received notification of a $14K annual merit scholarship from Muhlenberg (also a small private liberal arts college in Pennsylvania). The amount awarded equals the Muhlenberg net price calculator result.

Thanks for the update!

Thanks Jess for letting us know that the net price calculator and the actual award for Muhlenberg matched! I visited Muhlenberg with each of my children and think it’s a lovely school.

Lynn O.

I know anecdotally that some selective schools that say they are need blind and/or don’t offer merit aid but they do have ways of offering nicer financial packages to middle-class kids they really want.

Is there any way to tell which might bend if they want a student, versus those who follow their price calculator pretty faithfully?

Hi Kimberly,

I don’t think any schools are need blind. I’d ask schools how accurate their net price calculators are. It’s going to be easier to have an accurate calculator for an elite school that only offers non-need-based aid.

Lynn O.

I worked as a financial aid counselor, and honestly – the NPCs can be pretty bogus sometimes. This is ESPECIALLY true for middle-income families. My bottom-line recommendation for families with middle to high income is to focus on the costs: http://bit.ly/1BRFU0j Hope that helps!

Using the NPC helps identify those schools that award scholarships based on merit (high GPA and test scores). Many highly selective schools do not award for merit. Good to know before you even get started. Of course getting a merit scholarship is likely a whole different matter.

I have run the NPCs for all the schools my daughter is applying to, and I have found them to be very uneven in the amount of merit assistance they choose to estimate based on GPA, stats, etc. Northeastern (cited above) was actually the worst of all of them in this respect — it’s final page contained a note in the margin that its NPC does not estimate merit aid, but that scholarships are awarded ranging from a few thousand dollars to full tuition.

Since we are a high EFC family with three younger siblings to plan for, besides a high stats senior, merit aid is highly important to us. I wonder if you or your readers can comment on the quality of various schools NPC’s estimates of merit based scholarships?

From what I have seen, the NPCs do include merit aid (as long as one’s GPA and SAT/ACT scores are pretty high and the school asks for that kind of information). As mentioned above in the article, you can modify the information in the NPCs to see where a school’s cutoff merit aid is. Usually the NE and West coast schools charge more, while the ‘bargins’ are in the Midwest and in the S and SE states. I am currently running the NPC’s for many schools (because once you have run a few you can ‘crank’ them out pretty quickly) and every once in a while, you find a school that rewards merit (almost always schools you likely have never heard of). With all the NPCs available now, it sure makes it a lot easier to pick a school first on what you can afford rather than pick a ‘dream’ school first and then find out there is no way you can afford the school (saves on creating false goals).

Mark, I think it’s a great idea to ask parents to provide a comparison between the NPC result and the actual amount schools come back with in their awards or acceptance letters. Like Rich, our family will not receive need-based aid but there are a few NPC calculators indicating that merit aid will be forthcoming. My child applied early action to a small private liberal arts school in Pennsylvania (Susquehanna University). I believe they accept around 70% of students who apply, and my child was just accepted with a $24K annual award in merit aid for 4 years, subject to maintaining a 2.5 cumulative GPA during college. The NPC for Susquehanna estimated a total grant award of between $20K and $23,500, of which it said $7,500 to $19,000 would be merit aid, and the rest in financial “need” aid (which seemed odd b/c it was the same “financial need aid” total whether I answered that we were applying for financial aid or not). Regardless, my child actually was awarded more in merit aid than indicated by the calculator: $24K awarded vs. $19K high end estimate. The calculator was detailed and asked for a lot of information about SAT scores, GPA, and class rank for the student and financial questions based on parent and child’s last tax return (Adjusted gross income, taxes paid, home equity, investments, cash in checking accounts, etc.) It will be interesting to see if other schools are accurate – I will report back on other early action results as received. As a comparison: The same student and financial stats at more highly ranked PA liberal arts institutions (Lafayette, Bucknell, Lehigh, etc.) yielded $0 in merit aid per their NPCs, which confirms some of what Rich may be seeing for his child. My child would be nearer the top of the class at Susquehanna; more average in terms of stats at the other colleges.

I have used the NPCs for several colleges/universities recently. The one question I have is how accurate are the results (I know, as you have mentioned, that several of the NPCs are basically worthless because they ask little)? It would be great if there are folks reading this blog who would be willing to list what the NPCs said they would pay and what they actually ended up paying after all was said and done.