Many parents worry that their college savings accounts will kill their chances for financial aid. Most families, however, who have saved for college are not hurt in student financial aid considerations.

Here are the two biggest reasons why saving money often won’t jeopardize your financial aid chances:

1. Colleges don’t care how much you (or your child) has saved for retirement.

The Free Application for Federal Student Aid (FAFSA), which anyone applying for financial aid will complete, doesn’t even inquire about retirement accounts. Colleges and universities that use the CSS/Financial Aid PROFILE, will ask about a family’s retirement accounts, but they won’t penalize parents for these

A family could have millions of dollars stuffed in retirement accounts and it wouldn’t impact their chances for need-based aid.

2. Parents can also shelter money outside of retirement accounts.

It might not seem like it, but colleges don’t want to strip you of all of your available cash. The financial aid formulas will also let you shield a portion of your non-retirement money through a savings and asset protection allowance.

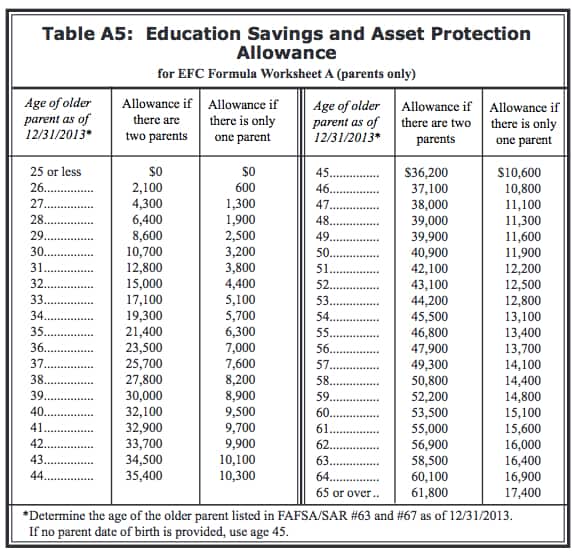

As you can see from the chart below that I pulled from the EFC Formula Guide, 2013-2014, how much you can shield from the FAFSA formula depends on the age of the oldest parent. The closer the parent is to retirement age, the greater the amount that is automatically shielded from the financial aid formula.

Let’s say the oldest parent is 53. The family would be able to shield $44,200 in 529 savings plan money, as well as any other cash laying around in taxable accounts such as savings, checking and brokerage accounts. In a two-parent household, a 60-year-old parent could shelter $53,500 from financial aid calculations.

The amount a mom or dad could shelter in a one-parent household is significantly less. A 53-year-old single parent, for instance, could shelter just $12,800.

Asset Allowance Illustration

Using an example should make it easier to see how this allowance would work. Let’s assume that a family has $75,000 in non-retirement assets, including $25,000 in a 529 savings plan, and the oldest parent is 53.

The family would get to shield $44,200 from the FAFSA formula, which would leave $30,800 unprotected. In calculating the family’s financial need, the FAFSA methodology wouldn’t expect the parents to sink all of that money into college. Consequently, the $30,800 in assets would be assessed at a parental rate of 5.46%.

When you do the math, the child’s eligibility for need-based aid would only drop by $1,737 even though the family had $75,000 in the bank. Putting this another way, the child’s Expected Family Contribution would rise by just $1,737. There is no guarantee, by the way, that a lower EFC would have generated a higher grant/scholarship for a child. The student might have just been offered a larger college loan.

Knowing this, would you rather be a family who saved nothing for college or the family who has $80,000 in the bank? Obviously, it’s always better to save money, whether it’s for college or retirement. Do so and you’ll enjoy more options.

The Shrinking Asset Allowance

A reader named Tim recently posted a comment on my college blog in which he noted that the asset protection allowance has been shrinking. Here is his note:

The EFC formula has evolved in the past few years to greatly reduce the asset protection allowance of parents. For example, the allowance for a 60-year old in 2011-2012 was $64,000 and only $45,500 for 2014-2015. That would amount to an increase of $2000 in EFC for many families. Do you know of any rationale for this? I thought the government was trying to make college more affordable, not less.

Here is my response:

You are correct that the EFC asset protection allowance has been declining. The asset protection formula is tied to the movement of Social Security benefits. When benefits are rising, the government figures parents won’t need to save as much for retirement and so the allowance is reduced.

Here is a great article from Troy Onik that explains what’s going:

New College Aid Formula Is Out, Penalizes Savers Additional 25%

Lynn O’Shaughnessy is the author of The College Solution: A Guide for Everyone Looking for the Right School at the Right Price.

There is a middle ground with participating in a 529 plan (staying within the shielded range) and using a cask value life insurance . Just depends on how much you are wanting to save and it take a tax expert or cpa AND an insurance agent to find the middle ground to maximize a strategy. It is a blanket statement to say life insurance agent are luring families away from traditional 529 plans and it would be sad to assume all agents, such as myself would advise against it. I work closely with my family owned tax practice and this is a biased view. Simplified yes but not the best strategy when leaving the tax man out of the picture. Fir so many reasons.

Author

Hi Pearlina,

Thanks for your observations. I do, however, totally disagree with you. Parents assets, including 529 accounts, are assessed at a mere 5% to 5.64% and there is an asset allowance so all allowable assets aren’t even counted. And retirement assets aren’t counted at all. The biggest factor is a person’s income. If a person has lots of parental nonretirement assets, chances are that person has a high income and wouldn’t qualify for financial aid anyway. And that’s not a problem because the family would just look for colleges with merit aid and the vast majority of them offer merit awards to high-income students. There is no reason to use expensive life insurance for college.

Lynn O’Shaughnessy

Hi ;

My husband passed away 10 years ago, leaving life insurance money for my 7 year old son. The funds were placed in Total Control Account and then later placed in CD. Is this asset reportable on the FSA?

hi, I have $$$ is custodial stock account for my son who is a junior in HS. Do I need to take the $$$ out of the account before the end of the year (2014) OR can/should I do it before Dec 31, 2015 (his senior year). My understanding is the $$$ in a custodial account for which I use his SSN would hurt more than if the $$$ was in my name somewhere. Should I take it out and hold it as cash? Appreciate the advice.

I am not a financial advisor, but if it was my money I would take it out this year – that way it won’t show up on the financial aid forms when you apply for your child. Child assets are assessed at 20% to 25% and parent assets assessed at up to 5.64%.

If you pay the applicable taxes and move the money into a custodial 529 plan, the money will be treated as a parent asset.

Lynn O.

If grandparents have contributed a substantiall amount to a 529, owned by them is it counted as a student asset at this point? I know when this was set up it wasn’t,, then it was, what is current? I have different opinions on this. If it is, should it be transferred to parents name so it only counts against parents after application of asset protection allowance?? Thanks,

Why is the amount a single parent can save so much less than a couple? Do the schools not understand that singles still need to eat and live? We are already penalized by not being able to take the tax credits if we make more than $75,000 where a couple can make twice that.

If you have two children in college, can you have twice that in savings? Both going in as freshmen the same year.

Great information for families to know. The better they understand financial aid, the more successful they will be in paying for college.

http://www.collegedirection.org

Thanks, Lynn! I meant a 529 account funded from a UGMA account (set up before there were 529s). Is that a custodial 529 account?

Kate — You would need to take the money out of the custodial account, pay any applicable taxes, and then put the money into a custodial 529 account. Once there the asset will be treated as a parent’s asset for financial aid purposes.

Lynn O.

Thanks!

Hi Lynn,

I read your book and thought it was one of the most helpful sources I’ve seen, so I was glad to find this website. I have a 529 question I thought I would ask here since I can’t seem to find the answer anywhere. Is a student-owned (rather than parent-owned) 529 treated as a parent asset or a student asset for FAFSA?

Thanks!

Kate,

I think you must mean a custodial 529 account. Whether it’s a custodial account or a regular 529 account, they are all treated as the parent asset for financial aid purposes.

Thanks for visiting my blog!

Lynn O’Shaughnessy

Lynn,

Nice article that once again, shows parents how much changes from year to year, even at the glacial pace the Federal Government tends to move!

It makes it challenging for a family to plan when the target keeps moving, but if they at least start planning, they will be well prepared for many of the potential financial “pitfalls” that their non-planning neighbors will be subject to.

Lynn,

Great blog. We have a HS senior and I check your site almost everyday. My question may be just a tad off the topic of shielded college savings, but since you are writing about 529s I thought I’d give it a shot. My parents (student’s grandparents) have generously put money in a 529 for years and we are planning on transferring the ownership to myself, the parent, as you have advised elsewhere. The amount, if not in a 529, would definitely be subject to a gift tax for federal and state (Michigan) taxes. Are ownership transfers of 529s subject to gift taxes? And does the FAFSA (that we’ll be filling out this January) consider the transfer as income and as an asset in the same year?

Thanks for your work, Dale

Dale — I don’t have all the answers to your questions at this point, but I should be Thursday when my tax source, who is bogged down with the Oct. 15 tax deadline, can get back to me.

Check back then!

Lynn O’Shaughnessy