When families look at financial aid packages they often assume that a school’s financial aid support will remain the same for four years. That, however, is a dangerous assumption to make.

The financial support that some colleges and universities give students will shrink after their freshmen year.

Bait and Switch?

Why would this happen? I can’t speak for schools that do this, but you could certainly make the case that colleges are taking advantage of this reality: students don’t have a lot of leverage. A junior, for instance, who sees a drop in his aid package probably isn’t going to leave for another school. Families are going to find the extra money or borrow even more.

Financial Aid for Upper Classmen

When you’re researching schools, you want to check not only the average level of financial support for freshmen, but for other undergrads as well. How you can determine if a university will become stingy (or stingier) after a student’s freshman year. You can use COLLEGEdata, one of my favorite college research sites, to find out.

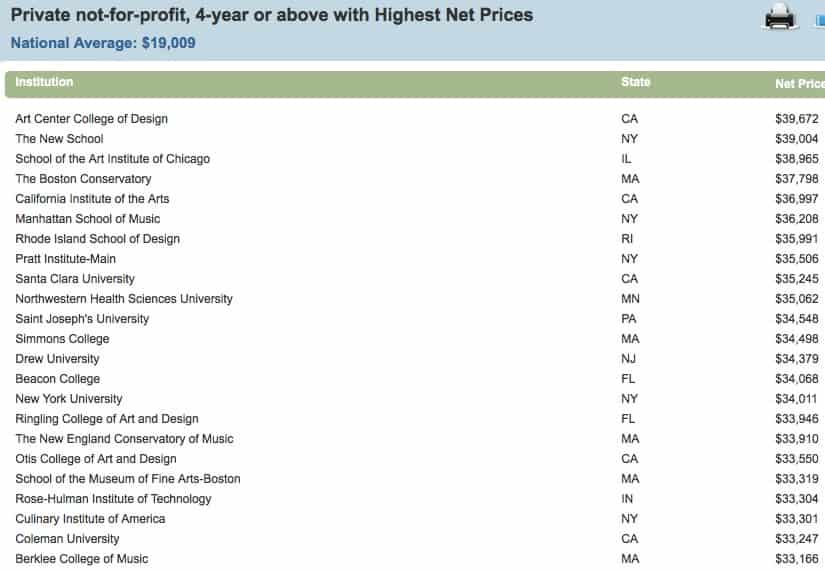

To illustrate what you can find, I first headed to the US Department of Education’s College Affordability and Transparency Center. I pulled the names of a couple of schools from the federal list of schools with the most expensive net prices after average grants/scholarships are subtracted. If you are going to need a lot of financial help to attend colleges, these are some of the schools that I would urge you to avoid. Here is the list of the private schools that are the worst offenders on the federal list:

I picked two schools from this list because I figured these stingy institutions would be more likely to reduce their aid to returning students. I selected Santa Clara University because it has the highest net price among private schools that aren’t in a niche like art and music. I also chose NYU because it is one of the most popular schools in America despite its dismal financial aid practices. At a college conference that I attended last year, I asked a rep from NYU why it had such poor financial aid and the rep replied that the school was “working on it.”

Santa Clara University

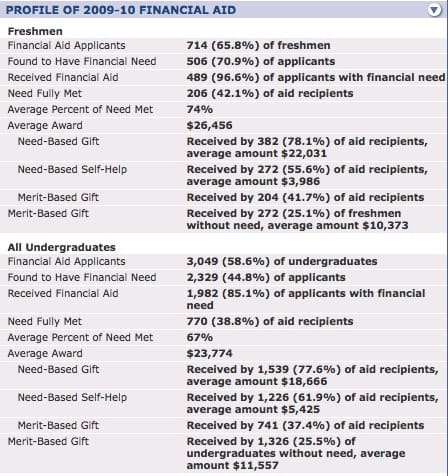

Here are the financial aid stats for Santa Clara University:

There is a lot to look at here, but what I want you to focus on is the percentage of financial need met for freshmen (74%) and the average percentage of need met of all undergraduates (67%). That’s a sizable drop in help and it’s reflected in the average need-based gift of Santa Clara students. The average need-based gift aid for freshmen was $22,031 versus $18,666 for all undergrads. That’s a difference of $3,365, which is considerable and doesn’t take into consideration that the price keeps increasing every year.

New York University

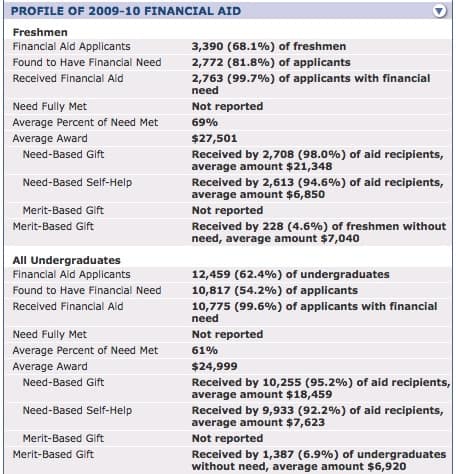

As you can see, the average percentage of financial need met for NYU freshmen – an underwhelming 69% – drops even further for other NYU students (61%). The average need-based grant drops from $27,501 to $24,999.

Babson College

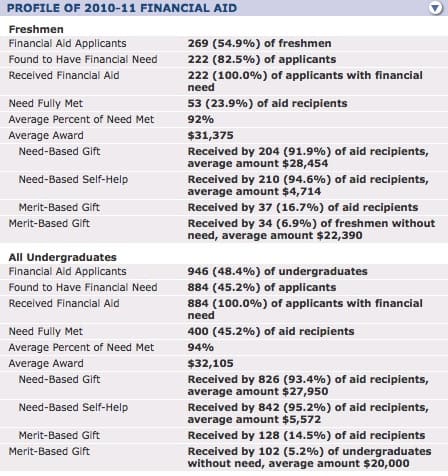

Just to show you that not all schools treat older students differently when it comes to financial aid, I’m sharing a school that I picked at random – Babson College in Massachusetts. The average percentage of need at Babson, which is a well-known business school, actually increased for upperclassmen. The average percentage of need for all undergrads (94%) was higher than for freshmen (92%). It’s nice to see aid going up because it would suggest that a school is helping its upperclassmen when their families encounter financial difficulties.

Bottom Line:

When evaluating a school check the generosity (or lack of it) for all students, not just freshman. Here is another post that I’d suggest you read that focuses on another helpful tool from COLLEGEdata:

Anatomy of a Stingy College and a Generous One

We have recently gone through this process, and it get much less publicity than warranted. Lehigh Univerity, a quality school in Pennsylvania, has just pulled such trick on our son. They gave us a decent aid package the first year that was enough for us to justify spending the $ to attend, and after one “tasteful and successful” year, the aid was pulled….saying the “aid was a mistake the first year”. You find this out in July of the following year, when it is basically too late to attend a different school. Be careful, this is excellent advice

University of San Diego cut their acceptance grant from $37,000 to $21,500 a month after we accepted the initial offer. not surprising they rank 12 th in list of schools to beware!

I love your posts Lynn. I always find them so informative. I have used the CollegeData website for two years now and love it. My only problem is that some of the data I find to not be up to date when I compare it to similar information on College Board. I assume most of the data from CollegeData comes from each schools Common Data Set or College Board, so it would be beneficial to look at that information too to make sure everything is up to date when considering future financial aid concerns.

Thanks for your comment Melissa. Yes, CollegeData uses the Common Data Set. I like your advice to check for the latest Common Data Set. You can usually find it by Googling that term and the name of the school.

Lynn O’Shaughnessy

Thanks very much, Lynn. I suspected as much, but wanted your professional opinion.

Lynn, you have provided a great resource for parents. This entire post is full of immediately usable information and clear explanations of how to read the statistics.

In the list of colleges with the highest net price, Pratt Institute is eighth on the list. I have an interest in that school, with three young friends already students there and/or seriously considering beginning there in the fall. When I search the “Money Matters” tab for Pratt on CollegeData.com, there is a glaring absence of information about the “Average Percent of Need Met” for both freshmen and all undergraduates. I searched College Board as well, and there is no information at all in their “Financial Aid Distribution” tab.

What should a parent make of that?

Hi Emily,

It’s almost always a bad sign when a school does not include the information that you mention. I’m assuming they don’t share because the figures are bad. And that makes sense since this school is among the worst in the nation when based on the net price that the average students pay at this art school. If money is an issue, I’d look for schools that do a much better job with financial aid.

Good luck!

Lynn O’Shaughnessy

Thank you! Your posts are consistently very helpful and practical. My daughter has received three acceptances and is waiting on three more. By using the links you provided, I was able to see the generosity (or stinginess) of each of the schools in students’ freshman and subsequent years. I had never considered that the aid might be reduced after her first year.

Glad I could helpl Laura! Good luck.

Lynn O’Shaughnessy

This is a very important and timely post, Lynn.

I do want to stress again that a school that says it meets 100% of a student’s need may consider large loans part of the “aid” with which they do so.

My son has been lucky enough to be admitted to 3 colleges that, according to CollegeData, meet 100% of a student’s need. However, one of the three will include loans in the package, making for a much less generous offer. This is not obvious from the College Data site. Families should always check the school’s financial aid page on its website to be sure of what is and is not considered “aid.” We are not on board with our son (nor us) taking on big debt.

Two of his other three meet 100% of need without loans, for both freshman year and beyond. However, who knows what each school will define as our “need” number? This number that is subject to interpretation by different financial aid offices, from what I understand, based on their own mysterious formulas.

It will be very interesting to see what the real bottom line is at these schools. This part of the waiting is actually more stressful than waiting for acceptances was, as he will not feel free to make a decision until all the numbers are on the table.