I wanted to share an email that I received over the weekend from a mom named Linda, who is questioning whether her bright son’s No. 1 college choice – Cal Tech – is out of reach financially.

Mom’s Email

Here is what Linda wrote:

My son, a rising freshman, has dreamed of attending Cal Tech for years, which others have said is possible because of his abilities. I have told him to continue to do his best academically, but not to set his sights on one school, or even a top tier school, because it will all depend on affordability.

I am reading The College Solution (2nd edition), and decided to take your advice by calculating our Expected Family Contribution and running numbers through various Net Price Calculators. I was SHOCKED to see that our EFC is $37-44K, depending on the college!

Yes, my husband makes very nice income, but we also live in expensive Southern CA. We don’t drive luxury vehicles, and our cars are 8 & 12 years old. We don’t go on pricey vacations or have expensive toys, such as a large screen TV! We have had several financial crises in the past five years that have nearly wiped out our savings. We would be hard pressed to pay for one year’s EFC, let alone 4 years worth. And this is just for one child!

Unfortunately, Caltech no longer gives merit aid, and it doesn’t seem other schools of similar caliber (MIT, Stanford) don’t either. Is there any hope of my son attending his dream school, or are we being totally unrealistic?

My Response

First, I want to congratulate this mother for being proactive in evaluating whether schools on her son’s dream list make sense financially. Unfortunately, many parents and teenagers never try crunching the numbers in advance.

Sadly, most parents only discover what a school will cost months after their child has applied. They learn what the tab will be when their child receives a financial aid package, which they may only get a month or two before the freshman deposit deadline.

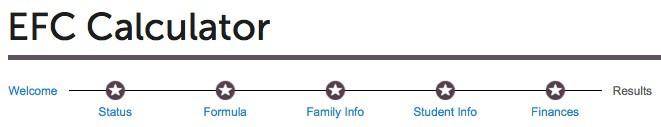

The better approach is to follow the lead of this mom and use an Expected Family Contribution calculator. I’d recommend that you use the College Board’s EFC calculator (See below).

Here is a previous blog post that further explains what an EFC is:

What Is Your Expected Family Contribution?

Determine Your EFC

The EFC calculator provides an estimate of what a family would be expected to pay, at a minimum, for one year of college. The EFC, which is expressed as a dollar figure, can be as low as $0 for a poor family.

The more affluent the family, the higher the EFC will be. There is no EFC ceiling for a wealthy family. A rich dad, who is a corporate executive of a national restaurant chain, once told me that when he calculated his EFC, it was $108,000. Obviously, no school costs that much. In this case, the family was going to explore schools that give merit scholarships to rich students and most colleges do. I’ll talk more about this in my next post.

EFC discussions inevitably lead to the questions about what financial aid formulas calculate. Unfortunately, financial aid formulas don’t take into consideration the cost of living in a state or region. Not surprisingly, this is a sore point among families living on the coasts and in other high-priced areas.

Critics rightfully complain that the methodology used to calculate EFC figures for millions of Americans isn’t always fair. In fact, it’s likely that the EFC won’t pinpoint what a family can truly afford for college. It’s no wonder since the EFC formula is actually a political creation. Congress dictates how the formula calculates families ability to pay for college.

Regardless of whether a EFC verdict is fair or not, families need to calculate in advance what kind of financial commitment they face.

I’ll have more thoughts on Linda’s dilemma in my next post.

Online Appearance Tuesday

I will be a guest on the Vanguard Group’s webcast on Tuesday that will include advice for families who are grappling with how to pay for college. You can sign up to watch here:

Lynn O’Shaughnessy is the author of the second edition of The College Solution: A Guide for Everyone Looking for the Right School at the Right Price, which was released this month.

It is my understanding that Caltech is one of the few colleges in the nation that strive to meet 100% of need.

Actually Melinda, there are a few dozen colleges and universities that do.

Lynn O’Shaughnessy

Enjoyed the article as well as your post on the EFC. Thanks for taking the time to continue to share your knowledge and help those looking for options to get loved ones (or themselves!) to college.

Can’t wait to hear what strategies you will recommend!

I am terrified of the cost of college. I have been playing with the net cost calculators and every college I’ve tried comes up with us owing about 40,000 per year.

Do they really expect people to be able to fork over one-third of their gross pay!? Seriously, isn’t literally 66% of our income a bit much!?

BTW – Love your website – thanks for all your help!

Is there any advantage for a child to file their taxes as a non-dependent, thus separating them from their parents for financial aid consideration?

Is there any advantage for a child to file their taxes as a non-dependent, thus separating them from their parents for financial aid consideration?