Many colleges do a horrible job of presenting their financial aid awards in an easy-to-understand way. As I’ve been explaining in my last two posts, I believe this is largely intentional:

What’s Wrong With This Financial Aid Letter

Evaluating a Financial Aid Award

Recognizing this shameful behavior, the federal government has created a financial aid template called the Shopping Sheet. If you receive a financial aid award that uses the Shopping Sheet as a model it will be far easier to understand whether a school is being generous or stingy.

I am not surprised that the vast majority of colleges and universities have rejected the Shopping Sheet.

Just today I was reading an article in the student newspaper at George Washington University that focused on why this extremely expensive university was not using the model award letter despite student interest.

GWU’s associate vice president for financial assistance told the student newspaper that the federal government’s model financial aid letter would be confusing. Seriously????

I find it laughable that the GWU administrator is worried about confusing families. A GWU financial aid award that l saw last year did a superb job of M-I-S-L-E-A-D-I-N-G the recipient! Please read the post that I wrote about the GWU award letter in 2012 and then decide for yourself what GWU’s true intentions are:

Is this a Good Financial Aid Award?

Financial Aid Shopping Sheet

Currently less than 10% of schools in the nation are using the federal Shopping Sheet, but you don’t have to wait for the schools on your child’s list to take advantage of this model award letter. There is a new service from College Abacus that can help you recreate any award letter into a easy-to-understand one. I’ll explain this service in my next post.

Below you will see what the federal Shopping Sheet template looks like.

The Shopping Sheet Features

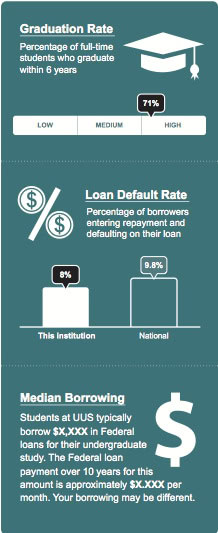

Unlike nearly all college financial aid awards, this model document does not mix loans with scholarships and grants. It lets you know what your net cost will be by subtracting just the free money from the total cost of attendance. All awards letters should be doing this, but most don’t.

Below the net price on this template, you will see federal student loan options and work study. The document also mentions other ways to pay such as borrowing through Parent PLUS Loans and private college loans.

You will also see what your Expected Family Contribution is which is extremely important. I just wish the Shopping Sheet would have identified it as the family’s EFC rather than just labeling it as Family Contribution.

Your EFC, which is determined by financial aid methodologies, is what you would be expected to pay, at a minimum, for one year of school. If you have a low EFC, the school should be giving you a higher amount of aid. If the school didn’t, then you were gapped.

Without knowing your EFC, you won’t be able to determine if the award is a good one or not. Colleges, however, typically do not provide a family’s EFC on their award letters.

Other Features of the Shopping Sheet

I also like the fact that the model financial aid award also includes the graduation rate of the institution and compares it to its peers. It’s frustrating, however, that the form only includes the six-year rate. The four and five-year rates should be included too.

It’s also helpful to share what the average student is borrowing to attend this school. Keep in mind, however, that this doesn’t include parent borrowing.

Schools Using the Shopping Sheet

As I mentioned earlier, most schools have not adopted the Shopping Sheet. I want to applaud those that have. You can see the entire list by clicking on this Shopping Sheet Excel Spreadsheet.

When I looked at the list, most of the participating schools were for-profit schools such as the University of Phoenix.

State schools that are participating include University of Texas-Austin, Arizona State, University of Delaware, University of Iowa, Iowa State, many, if not all, SUNY’s in New York state, Auburn, Boise State, many Penn State satellite campuses, Georgia State and University of Virginia.

Private, nonprofit schools that I saw on the list include Smith College, Cornell, University of Miami, Rollins College, University of Rochester, Coe College, Lawrence University, Stonehill College.

I want to applaud all the schools that decided to simplify their financial aid forms and I hope many more institutions join these trailblazers before next year’s admission season!

Lynn, Can you provide details on that CSS formula that you mention?

Julie…the CollegeBoard keeps that info very tight to their chest. There are a list of “service options” that colleges sign up for when they take the CSS for institutional need based aid….like how they want the home equity handled, or how much weight they give to student assets…and that is kept very tight also. You have to “know people who know people who know people”… 🙂

Lynn may have some insight with all her experience.

Here is the definition of EFC: The Expected Family Contribution (EFC) is a measure of your family’s financial strength and is calculated according to a formula established by law. Your family’s taxed and untaxed income, assets, and benefits (such as unemployment or Social Security) are all considered in the formula. Also considered are your family size and the number of family members who will attend college during the year.

This number should be the same at every college – it is a federal formula, not an institutional one. How the school uses that number may change; other factors may figure in using Special Circumstances, such as unreimbursed medical expenses, private school tuition, etc. but those factors do not change the EFC itself.

LindieSue — Thanks for your comment! The EFC can change because CSS/Financial Aid PROFILE schools use a different formula for their institutional money.

Lynn O’Shaughnessy

As a parent of three college students, and former employee in Financial Aid, I think the biggest factor is missing. What is the anticipated (based on average of last ten years) amount of annual increase in tuition? (Most schools this will be between 4-7%) How will the student’s award package be adjusted to reflect this amount (most schools only increase loans, not gift aid)? And, then, extrapolate using [the average number of years to a degree X the amount of indebtedness per year] to find the bottom line: total indebtedness at graduation. In other words, about how much should you plan on paying for that degree? If you can barely afford the first year, forget about managing the fourth or fifth – unless you’re at one of those rare schools that freezes tuition at what it was when you entered.

And, if you do end up using loans, figure out how much interest you’ll pay on the interest and consider contacting the lender (not the school) to ask if you can pay “the interest only” on your loan while you’re in school (usually $25-50/month). This is a great option for the student to start managing his money while in school, and understand the importance of budgeting and how compound interest works. This option is not something the lender will volunteer to you – be proactive!

Great reply LindieSue!

Can I request our EFC from the schools? We know what it is from the FAFSA, but it appears that several of the schools are using a different number. (The only school that has put EFC on their award letter so far is William and Mary).

Hi Cindy,

Sure you can ask any school for your EFC.

Lynn O’Shaughnessy

My daughter just received her financial aid letter from Denison University (not listed the Excel spreadsheet) and they followed the Shopping Sheet format TO THE LETTER. I thought it was the best financial aid document I had ever seen! No separate analysis or decoding required.

Thanks for sharing Angelo! I’m glad to hear that Denison is on board.

Lynn O’Shaughnessy

I have a friend that I will share College Abacus with. They are waiting to receive GW’s Financial Aid offer.

I was excited to see University of Rochester on the list, but I’m guessing they are working on adopting this for next year. My daughter recently got an award letter from them and it was just as confusing as all the others. It had scholarships, loans, etc. broken down by semester (Why do they do that?) and it had no mention at all of what they used as the EFC. I sure hope more schools will decide to use this format. It is SO much better than every letter we have received this year!