How do you research financial aid and merit scholarships that a student might get at individual colleges and universities?

With college sticker prices continuing to climb, it’s an important question to ask because the financial aid and merit award policies at schools will vary widely. Not knowing how to research the generosity or stinginess of individual colleges can cost you tens of thousands of dollars extra or much more.

The website that I recommend using when researching the generosity of individual schools is CollegeData.com.

Using CollegeData

CollegeData.com, a free resource that I’ve been using for years, is a valuable website to bookmark when on the hunt for affordable schools.

(I used to also recommend the College Board website for financial research, but when the site was remodeled, some valuable statistics for schools were eliminated. What’s more, the College Board now prominently displays average net prices that, in plenty of cases, are misleading.)

On CollegeData, you can discover what the average need-based and institutional merit scholarships that a specific school offers, as well as what percentage of students receive each type.

Getting Started on CollegeData

Here are the steps to take on CollegeData’s website to generate financial statistics for a school:

On the home page, type in the name of an institution:

You will be brought to the school’s profile where you can discover a great deal about an institution including admissions statistics, majors and campus life.

For this example, we are interested in the aid statistics so we will click the Financials hyperlink. I am using Stanford University as an example of one of the highly rejective universities that provides excellent need-based aid.

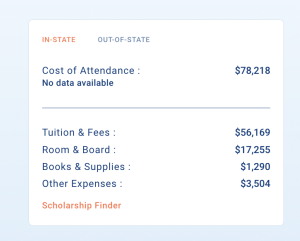

What you will see at the top of the financial section is Stanford’s cost of attendance. Most families don’t pay full price for college, but it’s a good starting point as we dive deeper.

Next scroll down to the school’s Profile of Financial Aid.

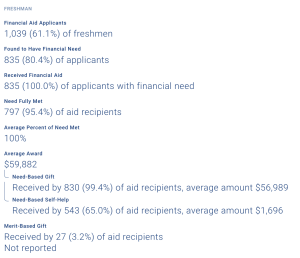

Here is a screenshot of what you will find for Stanford freshmen:

This section on freshmen aid will give you a good idea of how generous a school will be.

You will first notice that only 61.1% of freshmen applied for financial aid even though the cost of attendance is more than $78,000. That shows that a large percentage of the freshmen class are so wealthy that they didn’t even bother to apply for assistance.

Of those who applied for aid, 80.4% were qualified to receive aid and 100% of that group received financial assistance.

Check Stats for Need Fully Met and Average Percent of Need Met

One of the statistics that I find most relevant is this one: Need Fully Met.

Ninety-five percent of Stanford students who needed financial assistance (as determined by a financial-aid methodology) had their full need met. That’s excellent (although 100% would have been better) and only a few dozen colleges and universities in the nation can make the same claim.

Also excellent is Stanford’s Average Percent of Need Met, which is 100%. So just about everybody who had a demonstrated financial need got their full need met.

What it means to get your full need met

Here’s an explanation of what meeting full need means:

Let’s say a Stanford freshman’s Expected Family Contribution (EFC) was $35,000 with the school’s cost of attendance at $78,218. The student’s demonstrated need would be $43,218. Stanford’s statistics suggests it would meet that need.

Note: If you don’t know what an EFC is, please read my blog post on the subject:

Expected Family Contribution: 10 Things to Know

Looking for grants in financial aid packages

The gold standard is for a school to provide that assistance entirely or almost entirely via free money – grants. When calculating what percentage of need it meets, a school is only supposed to include the Subsidized Direct Loan since it has a perk that other loans don’t have. The interest on subsidized loan is covered by the federal government when the student is in school and for a period after graduation.

Almost all schools put the full Direct Loan into a freshman’s package, which is $5,500, but Stanford is part of a small no-loan group of rich private institutions that do not. The self-help in the Stanford package would be for a federal work-study job.

Some schools, however, calculate their average need met by including the Subsidized and Unsubsidized Direct Loan, as well as the federal PLUS Loan for parents. That is a dishonest move.

In Stanford’s case, nearly all the assistance comes from need-based gifts ($56,989), which is great. Meanwhile the average amount of need-based self-help (loans and work-study) is quite low at $1,696 because, as mentioned, Stanford admirably doesn’t meet need with loans.

Check for Merit Awards

For your affluent clients, the most important information will come under the Merit-Based Gift section. If a school gives merit scholarships to students without financial need, this is where you’d find it.

Stanford gives a small amount (3.2%) of merit aid to students with financial need. I suspect that would be students who got their full need met via Stanford, but also had some outside private scholarships.

The next line – Not Reported – is what is relevant to high-income students. When it says, not reported, it means the institution does not provide merit scholarships to students with no financial need, as determined by the school’s aid formula. I am puzzled why it’s never noted with a zero.

Looking at Stanford’s statistics, you can see that this is a very generous school for students who have need, but a full-price university for high-income students whose EFC exceeds the cost of attendance.

Check freshmen stats with undergraduate stats

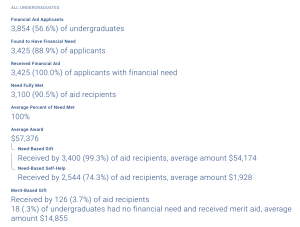

CollegeData also provides the same statistics for all undergraduates at a college. By looking at these stats, you can see if the award packages are front-loaded. That means the awards are much better in the freshman year than subsequent ones.

In Stanford’s case, the aid policy didn’t change. The average percentage of need met was the same and the awards were very close.

You will see under the Merit-Based Gift section, that a few undergraduates (18), with no financial need, received merit aid averaging $14,855. At some point, Stanford was giving out a tiny number of these merit awards, which it stopped.

It is worth using CollegeData to see if an institution is front-loading awards. One egregious example of front loading that illustrates this phenomenon comes from American University in Washington, DC.

For freshmen, American University says its average percentage of need met was 92% and that 48.5% of freshmen had their need fully met.

In contrast, for all undergraduates, the average percent of need met drops significantly to 75% and those having their full need met was just 22%.

New York University: Financial aid and merit scholarships

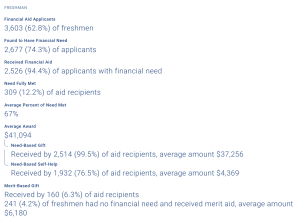

Now let’s look at the statistics for New York University, which is an example of an institution that is known for offering poor financial aid packages, as well as meager merit awards.

This school meets a low percentage of financial need (67%) and only 12.2% of freshmen recently got their full need met, which is truly dreadful.

Actually, for many of NYU’s accepted applicants, the percentage of need met would be even lower. Why? Because the 67% figure only reflects the students who ultimately enrolled at NYU and didn’t include students whose award packages were so awful that they enrolled elsewhere.

In addition to being stingy with need-based aid, NYU also is terrible with merit scholarships. Among freshmen who had no financial need, just 4.2% of freshmen received a merit award that averaged just $6,180 for a school that costs $81,000.

NYU clearly doesn’t have to give good need-based aid or merit awards because so many teenagers want to attend the school because its located in New York City.

Beloit College: Financial Aid and Merit Scholarships

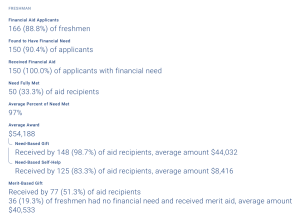

I selected Beloit College, my son’s alma mater, to illustrate a school that provides students with very good need-based aid for students who need financial help, despite not being a highly rejective school, as well as extremely high merit awards for affluent students.

Unlike universities located in cities on the East and West coasts, schools like Beloit have to try harder to attract students because they aren’t in urban areas. In Beloit’s case, that means better financial aid than most schools and amazing merit awards.

While the majority of freshmen didn’t get their full need met at 33.3% (the vast majority of schools don’t), Beloit meets a very high percentage of need at 97%. This high percentage is usually only seen at highly selective schools that provide excellent financial aid but little to no institutional merit scholarships.

For affluent families, who won’t qualify for need-based aid, the average merit award at Beloit is huge at $40,533!

Bargains can be found at many liberal arts colleges and master’s level universities in the Midwest and South and interior West. The merit awards, in particular, can be better and the sticker price of these schools can be $10,000 to $20,000 lower than popular coastal schools.

Bottom Line:

When money is an issue, it’s critical that families evaluate the aid practices of potential colleges and universities and CollegeData is a good tool to help.

Great to see Beloit appear, since I first read about it in Loren Pope’s Colleges That Change Lives book. Good to know they are generous with merit aid as well. Seems like a hidden gem and relative bargain. I’ll give this school another look.

Thanks!

AWESOME AS USUAL lYNN!!

Isaac Lewis

Valley Christian High School

San Jose

I would be very curious to see updated financial aid data for NYU. For the past two years, I have seen excellent award packages, meeting full need for my low income students. I understand that two years ago NYU started meeting full need (at least for Pell eligible students). You might want to consider using a different college for your second example (I can think of many but won’t call any of them out here :))