Today I’m answering a question from a father, who is puzzled by the Expected Family Contribution figure he generated when using an EFC calculator. I think my answer to him will be helpful for just about anybody who will eventually be filing for financial aid.

If you don’t understand what the term EFC is, please read this post first: What Is Your Expected Family Contribution?

Dad’s Question:

Our adjusted gross income is about $100K and we have about $150K in taxable investments. We also fund two 401ks at 15%.

At 51 years old, I am the oldest parent. We were surprised that our FAFSA Expected Family Contribution came in high at $36K. It seems high compared to the examples that you give in your workbbook, Shrinking the Cost of College, for our income and savings/investments.

Has the EFC for a given AGI increased over the last couple of years? The FAFSA form seemed straight forward and am pretty certain that we filled it out correctly. Does the EFC of 36K seem about right for our situation?

Answer:

That EFC may be right. I tried using your figures myself by using the College Board’s EFC Calculator, but I didn’t have everything I needed including how much in taxes you paid and the number of people

Here are a few things that you need to keep in mind:

Point No. 1:

You and your wife have a considerable amount in 401(k) plans (Congratulation!) and you don’t pay taxes on the contributions, which are automatically stashed away in these workplace retirement plans.

In calculating your EFC, the financial aid formula adds back in the tax deduction that you receive for your contributions. In other words, the tax break you captured for contributing pre-tax dollars to you and your wife’s 401(k) plans will be added back into your income for financial aid purposes. This money is considered untaxed income.

This isn’t an issue, however, for parents who contribute to a Roth IRA because those contributions are made with after-tax dollars. In other words, you don’t get an upfront tax break for contributing to a Roth, which by the way is an excellent way to save for retirement. If you want to learn more about the beauty of Roth IRA’s, here is a really old blog post that I wrote when I was still a financial journalist: Why the Roth IRA is Superior.

Point No. 2:

The FAFSA formula only cares about retirement contributions for the 12-month period that the application covers. As I already mentioned, the contributions are considered untaxed income. The FAFSA, however, never asks about how much you have stashed away in retirement accounts because that is irrelevant for financial aid purposes. You could have millions sitting in retirement accounts, but it wouldn’t increase your EFC at all.

Point No. 3:

When you file for financial aid, the FAFSA formula automatically exempts some of your non-retirement assets from financial aid calculations. The older the parents, the more they can shield because older parents are edging closer to retirement.

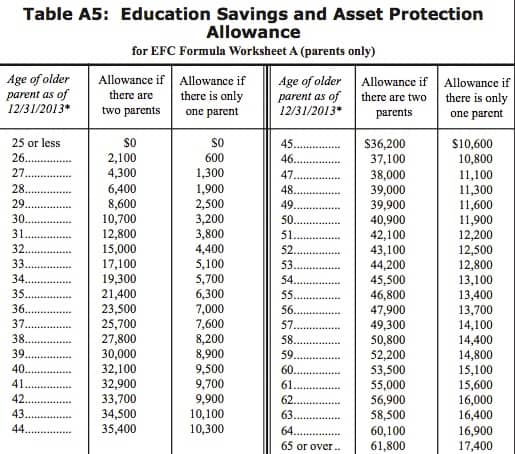

The bad news is that this asset shelter – formerly called the Education Savings and Asset Protection Allowance – has been shrinking lately. Two years ago, for instance, a 51-year-old could shelter $54,200 in nonretirement money from financial aid considerations. Last year the figure dropped to $52,900, which is the figure the dad found in my college finance workbook that’s available on my website. For 2013-2014, the asset shelter has dropped to $40,900. When the asset allowance shrinks, an EFC can rise.

Why the Asset Protection Allowance is Shrinking

I asked Mark Kantrowitz, a financial aid guru and the publisher of FinAid.com and FastWeb.com, why the allowance has been getting smaller. He explained that it’s because the annual allowance is tied to the Consumer Price Index, which can fluctuate significantly each year. Here’s what Mark said specifically:

The APA is the present value of an annuity which, when the older parent reaches age 65, would yield enough money to supplement Social Security benefits to the BLS moderate living standard. Since it uses current CPI as opposed to an estimate of average CPI of the next n years, the figure is very volatile, fluctuating from one year to the next.

So basically when the CPI and inflation is low, the APA will be lower because the parent with that hypothetical annuity wouldn’t need as much to live on in his/her future retirement based on one year’s CPI. It seems unfortunate that the government doesn’t use an average of several years worth of CPI figures, but that is the reality.

Because of the volatility, Kantrowitz advises parents to count on a range when contemplating their asset allowance. For a 48-year-old parent, which is the median age for a parent with college-age children, roughly $40,000 to $50,000 in non-retirement assets will be sheltered.

2013-2014 Asset Protection Allowance

Here is the asset protection allowance for the 2013-2014 year:

Lynn O’Shaughnessy is the author of second edition of The College Solution and her workbook, Shrinking the Cost of College, which is only available on her website.

I just tried the calculator myself.College Board says my expected contribution is 40% of gross household income. Really? At a tax rate of about 28% gross the expectation is to meet household expenses and retirement on 32% of gross income?

Are the Asset Protection Allowance tables the same for the CSS Profile as they are for the FAFSA? The EFC formulas frequently refer to the FAFSA, but seem to have no mention of the CSS Profile.

For a 2-parent family in which the older parent is 60, for 2015-2016, would about $41,700 of assets also be protected under the CSS Profiles formula for Expected Family Contribution?

Thanks!

Sorry, but there is no asset allocation allowance for the CSS/Financial Aid PROfiLE.

Lynn O’Shaughnessy

Thanks for all your information; I found it very helpful. Do you have a copy of Table A5: Education Savings Protection Allowance for 2014-2015? I am looking for the allowance for 2 parents, oldest is age 58 in 2015.

Thank you!

Gail

Hi Gail,

Here is the link to the EFC 2015-2016 Formula. You’ll lfind the table on page 19.

http://www.ifap.ed.gov/efcformulaguide/attachments/090214EFCFormulaGuide1516.pdf

Lynn O’Shaughnessy

My son starts going to college this fall.

Would it make sense to invest in Roth IRAs instead of traditional IRA for next 4 yrs? so the amount you will be investing will be less as the taxes will be taken out before investing and taxes you pay will be high, which will lower EFC? As you know, they add the IRA contribution for the current year to your income.

And when the student/me is an adult returning for a FT graduate degree age 50+ and the spouse is age 65, are the numbers the same? I have been unemployed for the last two years and my EDD benefits ran out December 2012.

Lynn,

Yes, 36K EFC seems right going by what I got when I filled out FAFSA 3 weeks ago. 2 Parents – Elder is 50 years old with one child to be in college

AGI – 116K; Assessable Assets – 175K (taxable account + 529 plans for 2 children), No assets on child’s name; 401K Contribution – 21K

EFC came to be at 37.5K.

What could I have done differently to get a lower EFC?

Thanks

Lynn,

Here’s a question you don’t see every day. This is embarrassing, but I need help. I didn’t know who to ask but you seem very knowledgeable about this topic and also very welcoming of stupid questions!

With gross household income of $400k, taxable investments of $1 million+ and 401ks of $500k, I know we have zero chance of getting financial aid. But I’m confused since all the experts say that we should apply even if I believe we won’t qualify. Does that really apply to us?

Also, I’ve always wondered if there is any non-financial reason for wealthy families to apply. For instance, is there a bias toward students in the application process if they checked off “NO” to applying for financial aid? I should add that my son is academically strong, works extremely hard and is applying primarily to top tier, highly selective schools. I want to make sure our high income doesn’t work against him.

Thanks!

Laurel

We have an adjusted gross of about $50,000 in 2011 and 2012 (Recently just lost job)

I have a rental house valued at about $160,000.

I do not have A 401k or any other retirement accounts. When i inquired with

FAFSA as to why we did not qualify for any Pell Grants ot State Grants, they said it was because of the rental property.

Would I be better selling the Rental house and investing in a 401K or IRA?

Hi Denny,

I wouldn’t pretend to be able to answer you question. I think you should pose that question to a fee-only financial planner or a CPA. There is a lot more at stake here than qualifying for a Pell Grant and there is no guarantee that you would qualify for a Pell Grant with an income of $50,000. In fact, it’s doubtful.

Good luck.

Lynn O’Shaughnessy

Lynn O’Shaughnessy

Quick note on point #3, Lynn… the $12,000 difference in the asset protection allowance from 2012-13 to this year, 2013-14, is only going to create a maximum additional assessment of $676. That’s taking the maximum 5.64% assessment the formula might use (although recently, I’ve seen assets hit at 3-4% for families like the one in this example) on the $12,000 difference. Not a big piece of the pie, as you know.

Interestingly, I ran the same numbers you used and the Federal EFC was about $29K but the Institutional was only $19K. Of course, I didn’t list any property, not knowing if this family is a homeowner, or not.

There must be something else in the background that is pushing the “Dad’s” EFC up to $36K, though. I’ll keep an eye on this post to see if he sends any updates!

Great info, as always.

HI Todd,

You are right. I decided not to add that to the post because it was already too long and I worry that people drift off when posts are lengthy.

Thanks for pointing out what I should have included in the first place!

Lynn O’Shaughnessy

This is very helpful. I like the advice of calculating based on a range rather than trying to get to an exact number.