I am sharing an email that I received Tuesday from a Wisconsin mom, who is stressed about the admission decision that her teenage son must make by May 1.

What follows is a cautionary tale for any families which have not been through the college admission process yet. Read on to discover how to avoid the kind of mistakes that this family made.

A Mother’s Email

- Stanford University

Our son has been a great student (4.0/non-weighted/Full I.B.). Very active in multiple extra-curriculars and a 34 on the ACT. He’s interested in chemical engineering and has been accepted at Stanford, Northwestern, Johns Hopkins, Duke, Washington University in St. Louis and the University of Wisconsin (we live in Wisconsin). Wait listed at Penn.

Never in a million years did we anticipate this. We encouraged him to apply because of his record and after hearing from so many people “the selective schools give you enough to come close to state tuition.” Not really, but, here we are.

So, we have two weeks to make this decision. We can not afford any of the selective schools and all have come in with roughly $30,000 in grants/scholarships–leaving our portion around $30,000. UW has offered him $10,000/year for four years. Husband and I can contribute $10,000/year but that’s all we’re comfortable with given that we need to focus on retirement and our other son who will be in college in two years.

Our son is conflicted. Doesn’t want to regret passing on Stanford or Northwestern (#1 and #2). The prestige and program at Stanford appeal greatly. But, there will be debt. We are uncomfortable with that much debt. In the long run, is it worth it? Hmmmm….there’s the million dollar question.

What loans do you even look for so that the debt will belong to the student not the parent? We want to give him sound advice, but said in the long run the decision will be his, but so will the debt. My pragmatic, midwest values say take the money and run to UW where he’ll come out debt free. Your advice/thoughts?

What Should This Teenager Do?

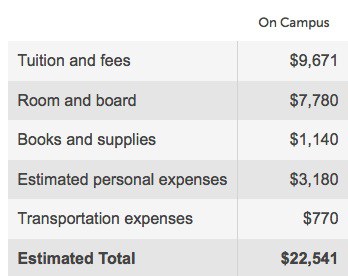

If you’ve been reading my college blog for any length of time you probably already know what I’m going to recommend. The financially responsible move would be to attend the University of Wisconsin! The figures I pulled from the College Board shows that UW’s tuition and room and board cost is going to be about $17,500 a year and the child can graduate without debt. It’s a no brainer.

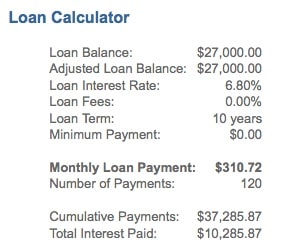

In contrast, the teenager would have to take out at least $80,000 worth of loans ($20,00 a year) to attend a school like Stanford or Northwestern and that assumes that prices remain stable. The teenager could borrow a total of $27,000 in federal Stafford Loans, which are designed for students. That’s a manageable figure because of built-in protections.

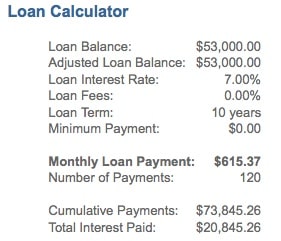

Even with federal students loans, the child would still have to borrow another $53,000. And he would have to seek out private college loans to cover these costs. The interest rates on these loans are variable and some students are borrowing at 9% or higher.

Teenagers and families can be emotional when choosing schools and weighing costs so I think it is important that they crunch the numbers before they commit their child to a future of crushing debt. That’s why I’d suggest that this family use a student loan calculator to see what kind of payments the son would face graduating with $80,000 in loans.

Using a Student Loan Calculator

I used the student loan calculator at FinAid and determined that he’d owe about $311 a month for his federal loans over a 10-year repayment period. The Stafford interest rate is 6.8% for all students.

I used an interest rate of 7% for his private student loans and I did not include loan fees for either loan, which would increase the costs:

Add these federal and private loan obligations up and this poor kid would be paying $926 a month. And, I should add, private lenders will show no mercy if the kid can’t come up with the cash each month. See how this puts things in perspective?

In my next post, I’m going to have more to say about what this family could possibly do to lower their costs. I’ll also cover what parents need to know about having two children in college at once.

Read More:

Should You Blow the Budget for Cornell?

Which College Should this NY Teenager Attend

Lynn O’Shaughnessy is the author of the second edition of The College Solution: A Guide for Everyone Looking for the Right School at the Right Price, which will be released on May 6.

So is there an answer as to what school the said student went to?

(It’s April 2014 and I’m in the same boat now) Stanford , paying 75% or Florida State University, Full academic ride.)

Stanford/FSU Dad

I want to hopefully help out. When your son is so brilliant he deserves to go to one of those schools because thats who becomes the leader. People will argue that it doesn’t matter where you went to school, but those are either the people that have not broken thru the glass ceiling or those that were lucky. When you go to Stanford, and yes, thats by far the best on that list there of amazing schools, doors are open. Doors that others can’t get to unless they have obtained graduate training from a top tier school as a prerequisite to admission to the best jobs. Hes going to be just another number unless he pushes to the nth degree, and has about 90% luck. It doesn’t matter how smart you are, but the fact that he is smart, he deserves the good degree to have the world opened up to him. Say he hates his job, shoot he can apply to wall street, he has the credentials to enter the front office even from a non-business major (engineering or something), say he wants to be in a tech start up, well heck Stanford recruits heavily there. Say he wants to enter medical school, heck, the top med schools and even the lower ranked schools will push aside that 3.8 average GPA and have your top tier degree holding soon come in the door. When residency comes along, some that wanted to be orthopaedic surgeons will be settling for other very impressive careers, but not necessarily what they felt they were meant to do, but your soon would probably gain admission. Looking all the way up and down the resume, that big ticket school could really be a permanent stamp of so called success. It doesn’t matter whos smart etc., following what statistically works (may or may not be published) is going to help your son make it easier for him. Lets say hes interested in academia in the future, he goes to some school that is not highly ranked, obtains a PhD, lets say hes not the top tier researcher, cant get major funding, whatever, he may be stuck at a smaller school. Lets say hes got a great PhD school (all schools have smart folks at them), the wheels and upward mobility may really take off in his career, making life easier. My two cents, maybe more than that, may or may not be right, but I think I’ve studied thousands of resumes and tried to identify trends of upward mobility. By the way U Wash is a really good school in many ways, outranks many of the ivys in different prestigous programs, but may not have quite the career zing as Stanford.

Is very interesting what you explain. The truth is that in Europe we do not have these problems because subsidize college. Think of the great cost of college is really hard. I admire your dedication, as parents and students.

Greetings!

Hi,

I faced a similar situation coming out of high school. I had been admitted to every college I applied to (even got a merit scholarship to a “name brand” (top 25) engineering program) and I also got just over full tuition at a decent state school (Top 75) and had applied thinking a cheap easy state school with a good medical school attached to it would be a good way to game the medical school application system. Once I worked at a hospital and started to realize that medicine wasn’t necessarily for me, I remember thinking in the that the full tuition scholarship was great but should be thought of as a backup plan for if financial aid comes through at my dream school and is not sufficient. My parents had different plans (didn’t care about anything except scholarship money, didn’t care to know, refused to be receptive, were fairly unmoved and dismissive when I got into my dream school). First of all, let your kid know he did great and he’s lucky to have empowering/supportive parents such as yourselves.

Having recently graduated from the free school (after my parents behaved the way they did, the last thing I wanted was to go back and ask them to be a cosigner on a private loan; interestingly as the market crashed in 2008 they found a way to pay out of state tuition at a less then top 100 state school for my slacker sister), I can tell you that I regretted having gone to the free school and found being there largely unfulfilling because the opportunities for recruitment into the best entry level jobs, exposure to an entrepreneurial environment, and academic rigor were all lacking compared to what was to be had at the school I would have happily paid for. You could just tell (sometimes professors would even say) that material had been dumbed down so more kids could be pushed through. Think about the immense value of a higher density of driven, highly capable students. Professors can actually teach at a higher level. I know there are plenty of people out there arguing to the contrary, but I studied a technical subject and went to a very hoity toity public high school, so I can tell the difference. College isn’t just a paper investment, it’s an experience and in an increasingly competitive society where people are just looking for an easy way to compare people, the brand name degree will provide an incomparable advantage. There are plenty of job posting that explicitly require such a degree. Don’t limit your kid’s opportunity set before he even gets out into the real world. The $1000/month will be chump change for an engineer coming out of Stanford if he just lives comfortably instead of extravagantly. Brand name schools get brand name speakers, brand name recruiting, brand name professors, and have the resources to support their students in doing things other schools just can’t (these brand names aren’t built on nothing). It’s also important to show your kid that his hard work is being rewarded. If he feels that the brand name advantage was oversold after one year (or even two), he can simply leave (Stanford is really great about letting you come and go basically as you please) or he can transfer to his cheap state school. Transferring the other way is much harder. He’s got his whole life to make money, but he’ll only go to college once. Going brand name will give him more options immediately and down the road; he will also probably have peers who have more to say in class, which is more than half the education anyway (learning through peer interaction). I remember I signed up for an entrepreneurship class at a brand name school nearby one semester, and it was far more fulfilling because my peers could keep up, had interesting things to say, and actually cared.

With that said, you’ll find all kinds of people everywhere (this was what I told myself as I arrived upon the free school’s campus) and you can make opportunities for yourself (I wound up at a job where I was one of the few non-brand name guys), but it’s a whole lot easier to find people you can relate to when your school has put a lot more into picking them out beforehand and it would’ve been nice to be enjoying college instead of jumping through hoops to prove myself all over again to potential employers why they should be interested in me despite my lack of academic pedigree. Also, you could set up an arrangement with your kid where you lend him money for college and are effectively making a retirement investment of sorts that is backstopped by the future income of your kid (which is probably a very reliable backstop).

Im a NY student facing the exact same issue, however I only have the choice of either Howard or Suny Farmingdale. If I attend Howard I would have about $80,000 in debt after ubdergrad and if I attend farmingdale I would be debt free. Im really stressing this decision because I feel like limiting myself to the city I would lose out on experience and networking opportunities, also because of Howard name I might get futher. On the other hand if I go away will the experience, networking and prestige outway my debt. Another issue im having choosing is that I applied to Howard as an independent student , I would thing I would recieve full financial aid but I only got offered a $5550 grant and $9,000 in sub/unsub loans. Ive had q hard lufe growing up in fostercare and feel that ive fought hard to get out of the city and make something diffrent, and even though I got my foot in the door by being accepted to a like Howard, financially its just bot a wise decision. Umm I also want to be an engineer. Sorry if I dont make much sense and if I come off very randon. I just really want to be successful and am so confused about the right decision. But please reply!! :'(

Hi Nef,

You should ABSOLUTELY NOT go to Howard. The debt would be CRIPPLING and it could ruin you financially. You can’t discharge private debt — assuming you could get a private loan with a high interest rate – in bankruptcy court. Borrowers could hound you and garnish your wages. Do not do it.

There is nothing magical about Howard, which should be avoided because of its poor financial aid. It’s not a school that opens doors, but the student. Start networking, meeting people, pursuing internship, look for undergrad research opportunities. Get to know your professors and anybody who can help. You don’t need to live in a city during your college semesters to accomplish this. My daughter, for instance, attended a school in rural Pennsylvania – 4 hours from Philly and 3 hours from Pittsburgh – she found lots of opportunities at her school and in summer months and had no problem getting a job.

DO NOT attend Howard!!!!

Lynn O’Shaughnessy

Yes to Stanford, Yes to $80k in debt.

Normally I agree with Lynn but there are exceptions, Stanford is THE exception.

Try to talk to a current 4th year Chem Engineering student or a recent grad and see what the new jobs pay in your field, I would be shocked if it is below $80k.

We are about to borrow $40k a year to send my daughter to a small liberal arts school in Penn.

You are doing very well with Stanford, don’t worry about the debt…Go for it.

Randy,

I would not borrow $40,000 a year to go to any liberal arts school. That is $120,000 in debt! Have you run a loan repayment calculator. That’s just too much.

Lynn O’Shaughnessy

Randy,

I would not borrow $40,000 a year to go to any liberal arts school. That is $120,000 in debt! Have you run a loan repayment calculator. That’s just too much.

Lynn O’Shaughnessy

For engineering field, most entry engineering positions are fully open to all qualified engineering candidates regardless of undergraduate schools’ reputation (so long as they’re accredited). An Ivy or Top 20/Top 50 degree doesn’t mean much to a senior executive hiring for engineering slots. Look at Illinois stats, and see that relatively little known Illinois Institute of Technology in Chicago beats almost all Midwest schools’ averages for both entry-level and mid-career positions. But it has compartively little reputation amongst high-flier parents and their children. And IIT has excellent merit financial aid for accomplished students. This Wisconsin boy could possibly have been granted a full-ride there, but certainly at least a large merit scholarship from IIT, and obtained his BS Engineering degree with little to no debt and excellent job placement.

“Prestige” factor clouds college choice for upper-middle-income parents and their kids. Outstanding students seem to be everywhere, and they all think that they’ve a shot for a merit scholarship at big-name college. I recently read that US has 35,000 high-achieving validictorians alone graduating each year.

I’d like to make a suggestion all the current posters to this blog. Sometimes we can’t see the forest for the trees Take a moment to look beyond the dollars. Look at the ranking of the Chemical Engineering department at UW compared to Stanford, et al. They are too close to discern any benefit to pay the extra freight at the undergraduate level. Stanford is only 2 places above UW, even if you use USNews rankings.

Go to UW. Save the money. $80K will pay for a great graduate education later, and he’d likely have the freight paid by his employer with such stellar grades and test scores. IF it was Stanford in computer engineering, that might be another story. But then again, in the tech world, the University of Illinois, Urbana Champagne is up there, and has their computer science guys getting same dollars out of Microsoft, Oracle, Cisco, etc.

We all overlook the most important factor about her son – he’s an overachiever, and will likely be the top in his class at UW. You can’t buy that success at any price. And, for fun, he can always “frame” his acceptance letters!

Thank you for your common sense David. You make an important point. The teenager is an overachiever and frankly should do well wherever he lands!

Lynn O’Shaughnessy

Honestly, I think I’ve learned as much from all the follow-up comments (and the link to your other post, Lynn) as well as from the original post itself! I’m so glad to read all these comments. This is quite a journey. Thanks everyone.

Susan– Glad you are getting so much out of this post — and all those great comments.

Lynn O’Shaughnessy

For more than 15 years, I worked at two large software companies where I hired marketing communications staff and freelancers for my staff. Some were right out of college, others were experienced senior people. We were well-known for paying good starting salaries.Good writing was essential.

In only one case did the college/university attended make a difference. That’s when I found a great junior writer who had a BA from Yale but minimal experience outside of school. It was her writing skills that got her in, and “Yale” helped a little when getting sign-offs to hire her (I later learned from her that she hated Yale!)

I regularly received 300 resumes for one job opening. Candidates from the Ivies or other prestige colleges never stood out over state university grads, for example, in terms of business/technology writing skills, attitude, aptitude for teamwork, analytic skills, personality (“do I want to work with you?”), cultural fit and so on.

Although some HR reps pick out candidates from the prestige schools, it’s because they don’t know how to judge specific skills. When it comes down to the hiring managers, it’s a different ballgame.

Thanks Denise! I always love hearing from parents who are actually in the position to hire college grads and know from first-hand experience if the institution on the diploma gives you an advantage. Your observation jives with the mom who wrote the post earlier in the week:

https://www.thecollegesolution.com/a-recruiters-take-on-hiring-students-from-no-name-schools

Lynn O’Shaughnessy

I’d like to take a different take on this.

The word “value” is often perceived as an absolute, but I believe it is relative to each person.

University of Wisconsin is a GREAT school. Not all prospective students can boast about having the option of attending a state school that offers what Wisconsin has to offer. Saving an extra $10,000 on top of that makes it a great option.

On the flip side, though the difference in total cost is far greater, perhaps the value that a Stanford, Duke or JHU has to offer outweighs the cost. Sure, if your son attends Stanford, he will spend far more on transportation and cost of living is far greater than other parts of the country. Depending on his emotional maturity and after gauging his interest in engineering, he may decide that being in Palo Alto has far more to offer in the long run. While receiving theoretical and experiential education may be comparable across these schools through research, lectures, and internships, you may want to explore learning about the culture of each university and its surroundings and see if they have something else to offer as well. For instance, if your son loves sports and student life is important, U of Wisconsin is great and so is Duke and Stanford. If he has interest in becoming an entrepreneur in the field of engineering, it is an exciting time to be in Silicon Valley.

Things to consider:

Student life

Employment prospect

Professional Networking

Avg starting salary undergrads: Breakdown by industry and how each university grads performed

Evaluating cost and figuring out the “break-even point”

Overall satisfaction of the school

At the end of the day, I think “cost” and “value” depends on how one quantifies all these variables. Cutting down on monetary cost may result in opportunity cost.

I’d like to add one more thing – Taking on a REASONABLE amount of student loans is not always a bad thing.

What’s a reasonable amount of student loans? That depends on your intended major and career, and the university’s track rate of students having jobs upon graduation.

I’d encourage this family to contact the career services and engineering departments of all of the schools under consideration to inquire about the average starting salaries for engineering majors over the last five years, and the percentage of engineering grads that have jobs lined up at graduation.

I’d be willing to bet that a Stanford engineering grad will be a hotter commodity on the job market than one from the University of Wisconsin. But, even at the University of Wisconsin, it’s unlikely that an engineering grad will be so poorly paid that they can’t comfortably carry a certain amount of debt.

Running the numbers through one calculator shows that 27,000 in Federal loans would require a salary of $47,000 to cover comfortably. Based on data from Payscale and NACE (see: http://www.payscale.com/best-colleges/degrees.asp), that should be very do-able for any engineering graduate, and extremely do-able if you major in one of the “hot” engineering specialties.

Now, if this student was planning to major in studio art or sociology, I’d definitely recommend against borrowing so much for undergraduate. And, of course, plans do change. But, again, I’d be willing to bet that a Stanford engineering grad would have a higher starting salary than one from most other schools. So, the family needs to do some more research before jumping the gun and deciding that the extra cost of any of these schools is not worthwhile.

Hi Carolyn,

I agree with you that taking on a reasonable amount of debt is fine. Taking the maximum amount of Stafford Loans is advisable. That said, I would not recommend that anybody take on a large private loan burden just to go to a brand name school. Engineers should make more money than an art major, but there is no guarantee about what this child would make just by looking at average starting salaries. And frankly schools play mickey mouse with their salary figures! Also, there is no guarantee that this child will succeed in the engineering program or that he decides he wants to be an engineer!

One of the beauties of going to college is that it opens the eyes of students to many academic opportunities. It’s no wonder then that many students change majors. I was one of them. I switched from history to journalism. A kid facing a horrific tab – based on the earnings capacity of an engineering major – won’t have that luxury.

Brilliant kids can do well no matter where they attend college. I’ve written about those studies in the past involving Ivy League schools. Here is a post that I wrote for US News on this topic: http://www.usnews.com/education/blogs/the-college-solution/2011/03/01/the-ivy-league-earnings-myth

Lynn O’Shaughnessy

Dixie,

Need blind schools do not necessarily give better financial aid. All a college is doing when they say they are “need blind” is not to consider your family’s need when they’re deciding whether or not to admit you.

The fact that a college is “need blind” is not a guarantee of anything beyond that.

There are, however, colleges – Stanford is one – that guarantee to meet 100% of demonstrated need for all admitted students, as well as colleges that come close to meeting 100% of demonstrated need for most students.

These schools are always the best bet for need-based aid, but not necessarily for merit scholarships. (Most of the schools that guarantee to meet full need don’t offer merit scholarships).

Since Stanford guarantees to meet full need, that means they DID meet this family’s full demonstrated need – in other words, they took the family’s EFC, subtracted it from the cost of attendance, and met the remainder in financial aid.

Where I see many families go wrong is making the assumption that “meeting full demonstrated need” means “meeting it all with grants.” In truth, the first thing most colleges do is drop the maximum amount of loans into a financial aid package. Then, they add grants, merit scholarships (if available).

But, very few families will end up paying LESS than their Estimated Family Contribution. As Sasha wisely notes above the time to realize this is well before April. There are good, reliable online calculators available that will let you get an idea of your EFC under Federal and Institutional methodologies (do not rely on the Net Price Calculators, however).

If you have a goal of only spending $10,000 a year, but your EFC is $30,000 a year, then you need to focus your child’s college search on schools where the cost is low enough that you will end up only paying $10,000 out of pocket, or where he/she is likely to earn a large enough merit scholarship to bring your EFC into line (the last is much harder to do these days).

The time to have these discussions is well before April of senior year – parents of juniors, take heed.

I think it is so important for these discussions to begin well before April of a student’s senior year. I am somewhat sympathetic to the family in question…however, at the same time I wonder how anyone thinks a $60K a year school is doable if they (the family) is only willing or able to pay $10K even though they are affluent.

This is a serious question on my part. How does someone believe that a top tier school is going to give them $50K a year to attend, especially with the tools out there to estimate your EFC? Where are the conversations about affordability in relationship to applications?

The student in question is going to succeed no matter what school they attend. They are obviously smart and qualified. I just wonder when the realistic expectations and understanding of the cost of college are going to become more widespread amongst high achieving, relatively affluent students and their parents.

Stanford, Northwestern…those are luxury choices. Very few people get discounts on luxury brands. Why is this so hard to comprehend?

Hi Sasha,

I agree with everything you said! Unfortunately most parents don’t know how to evaluate schools financially or academically. There needs to be much more education on college affordability and it should start with high school counselors. I’m not, however, holding my breath that this will happen.

Lynn O’Shaughnessy

It’s hard to evaluate schools academically pretty much other than knowing which majors they offer and how big the classes are. But to really know if a particular department within a school shines, to know if students are engaged collaboratively both in and outside of the classroom, to understand the culture of a school and the actual opinions and expectations of the faculty and students who reside there, these things are really hard to find out. How can families learn if the faculty are involved with students? None of this information is transparent, and schools seem more intent on marketing themselves like the newest appliance than they do on providing the data we need. So then what are families to do? I think that’s why we end up thinking that a brand name school might be best. At least there’s a self-selection bias where if your kid goes to the name brand school they are likely to be surrounded by highly motivated and academically qualified students and faculty. On the other hand, who wants their kid to go to school with a bunch of other privileged kids just like them? I think it’s really hard to feel like you’re doing a good job as a parent at this stage. The schools are in it for themselves. The politicians are in it for votes. And the rest of us are trying to figure out what the hell to do. Sorry for the rant. It is so frustrating!

I agree and think this is a great column when you include the discussion. A huge question is: which college can your child thrive and, most importantly, GRADUATE from? State schools are less expensive, but it’s very easy to get “lost” in one. My daughter is bright and self-motivated and she might do just fine. On the other hand, a smaller, more student-oriented school might be a place where she would really thrive. A college investment doesn’t pay off until graduation day, or after. People who send their kids to Stanford are often hoping their kids “friends” will be of the Bill Gates variety. Personally, I just hope mine has friends with good old-fashioned common sense and a strong sense of ethics. So you can see that like Susan and Lynn, I am overwhelmed. I guess I’m going to just pray, ask God for guidance, and let my daughter lead the way. I already plan to stick with her through thick and thin. All I can do is my best, if she does the same, God will take care of both of us.

Good luck Pam and good luck to your daughter where ever she attends college!

Lynn O’Shaughnessy

This is no-brainer!! Go to Stanford, your son is so lucky to have gotten in – it’s like winning a lottery, over and above a generous financial assistance of $30k/year. Stanford is need-blind, they can’t help that you parents make enough money not to qualify for a full-ride. The formulas are pretty straight-forward. I hope you as a parent decided this before making your kid go thru this harrowing experience. He should definitely attend, $80k is nothing compared to the value of a Stanford education, if he is willing to take advantage of the resources Stanford provides.

With all the schools this student was accepted to, I would agree that there is probably more than one school who would be willing to offer more $ in grants to have him attend their school. Also, perhaps if some of these schools are informed they are not in contention because of the need for more gift aid, they will offer more?

My daughter is making similar decisions. Her goal is to be debt free from undergrad, and take out loans for a good “name brand” graduate school possibly. I honestly think that she is leaning toward the state school.

One thing this kid did not do much of….which might be helpful for others with this great GPA and ACT…is to apply to need blind school. Your portion of tuition/room and board is what FAFSA says your family can afford. Many times this is about the same as a state school, and less than many of the name brand schools that are not need blind.

If this student’s credentials were strong enough to get into the engineering programs at the schools listed, he might have qualified for a full tuition merit scholarship at a private liberal arts school with a strong engineering program (such as Lehigh). How sad that he really has only one choice.

I would be interested in learning more about this student’s financial aid packages. What was their EFC and other details? I’m looking for more context. In my experience many if not all of these schools meet over 90% of need.

Love the blog.

Thanks.

Mikey — The schools that the parents can’t afford meet 100% of financial need — they are very generous. The problem is that this family is affluent — at least as measured by the financial aid formula. I can assume because the schools meet 100% of need and the family must kick in about $30,000 for all these $60,000 schools that their Expected Family Contribution is around $30,000.

Lynn O’Shaughnessy

Lynn,

Our experience has been that schools only consider “tuition” for financial aid not the total cost of attendance (room, board). The schools we applied to consider “loans” as part of the package, we received on average 60% of tuition in scholarships and another 15% in “loans”.

Is this considered a good deal? Our EFC was 19,000.00 and I still had to plead “special circumstance” to get additional help to bring our cost even close to the 19,000.00. We calculated Tuition, Room/Board, books supplies, travel, personal expenses in the total cost of attendance.