What are the most generous colleges and universities in the country?

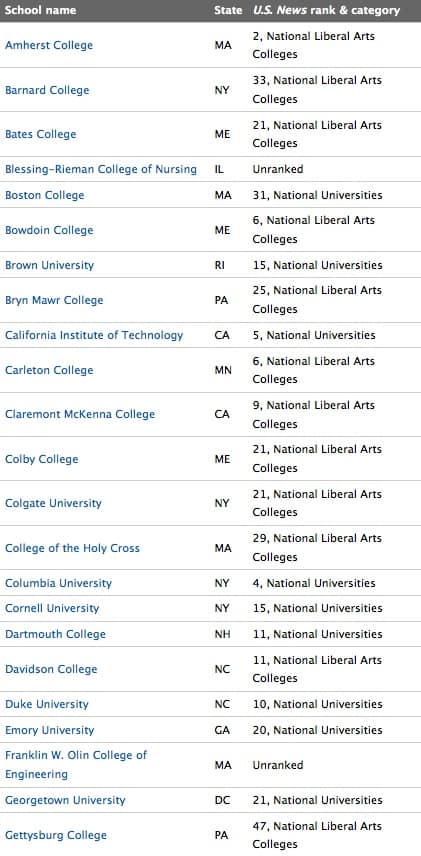

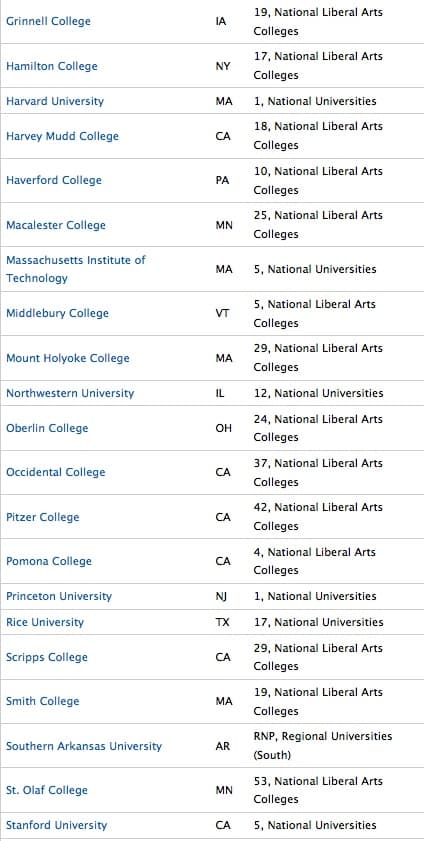

US News & World Report attempts to answer that question every year when it rolls out its lists of institutions that self report that they meet 100% of each student’s financial need.

Today I’m sharing the latest list that US News released last week. Not surprisingly, highly elite schools predominate. On the honor roll you’ll find members of the Ivy Leagues, for instance, as well as other prestigious universities like Rice, Stanford and Cal Tech along with prestigious liberal arts colleges such as Haverford, Middlebury, Smith and Carlton.

62 Most Generous Colleges and Universities

Winning the Educational Lottery

If you need money to go to college and you are accepted into one of these tough-to-crack institutions, you are an incredibly lucky person. In fact, you will have won the educational equivalent of the lottery. Most schools in this country, however, don’t possess the financial resources to meet anywhere approaching 100% of a person’s need.

If you’re confused about what meeting 100% of financial need actually means, here’s a quick explanation:

Any school will routinely base your need on what your Expected Family Contribution is. Your EFC is the dollar figure that at a minimum a college will expect you to kick in for one year of schooling. So if your EFC is $20,000 and the university costs $55,000, ideally you’ll get $35,000 in aid. At the schools on the list, you’d get that. At most of these schools, you’d receive all the aid in grants (free money),but some schools will include a small subsidized loan or work study.

At other colleges and universities, might get get 80% of your need filled or 68% or 93%. It’s going to be all over the board. You’ll have to judge just how generous all these other schools are by using the kind of tools that I’ve mentioned many times on this college blog. Here is one of those posts:

Measuring the Generosity of Colleges

Bottom Line:

By the time teenagers are seniors in high school, many of them chase after private scholarships after they realize that they will need help with college. As I’ve said many times before, this is the least lucrative source of college money. A dead-end for many. The most generous source of cash are the colleges themselves and to be in line for the biggest helping of grants and scholarships , you need to be the best student possible. The top way to help pay for college is to be an excellent student.

Thank You!

I want to extend a big thank you to everyone who over the weekend preordered a copy of the second edition of my book, The College Solution: A Guide for Everyone Looking for the Right School at the Right Price, which is about 90% new. A lot of you did!

If you want to learn more about the book, here is a post that I wrote last week about the new edition:

What I’ve Been Up To Lately

Hi, Lynn

As I know, the NYU Grossman School of Medicine providing full-tuition scholarships to all the matriculated students in the MD degree program(source: https://mcathub.com/why-new-york-university-grossman-school-of-medicine/). I think NYU medical school is really one of the Generous Colleges.

Thanks for sharing.

How can Yale be on the list for the most generous colleges and on a list for the stingiest colleges. In the article Yale denied an academic genius, with stellar SAT scores, and straight A’s throughout high school, but whose parents low-income qualified him for a pell grant?

Am I missing something?

http://www.cbsnews.com/8301-505145_162-37244908/the-nations-15-richest-and-stingiest-colleges/

Hi Salima,

Yale is extremely generous to low-income students who manage to get accepted into this Ivy League school. Low-income students at Yale or any other Ivy League school will get large financial aid packages.

The problem, however, is that Yale and most highly elite schools don’t accept many of these needy students! That’s why Yale and some of the other elite, rich schools land on the stingy list. These schools mostly accept wealthy students, who pay full price.

Lynn O’Shaughnessy

While all these schools may be “generous,” it is very important to note that many of them “meet the student’s full need” with a loan component. (Is that really generosity?)

Take Colgate, for example, which states right up front that a loan is part of your “aid”:

http://www.colgate.edu/admission/financialaid/componentsofaward

…as compared to Davidson, which gives grants, not loans:

http://www3.davidson.edu/cms/x32703.xml

Big difference!

To those looking for merit or academic scholarships look at the book “Colleges That Change Lives: 40 Schools That Will Change the Way You Think About Colleges ” by Pope. These are under-recognized but really great schools for “B” students. If yours is an “A” student many of them give great academic scholarships. My daughter is going to McDaniel College on a full academic scholarship. She got a nice offer from Ursinus College also, another one from the book.

Great suggestion. It’s not just the selective schools that offer a great education. As with many things in life, you get out of something what you put into it. Many of those “under the radar” schools are the best kept secrets in higher ed. Let go of the status of the “sweatshirt” schools and what others may think. Be open to the possibility of being engaged and intellectually stimulated in a school where the admissions criteria may be less than your child’s transcript and test scores. Think out of the box.

Regarding financial need, many parents complain when they are offered a loan as part of the FA package. Why? Where else can your child get subsidized and unsubsidized loans as an entitlement from the Federal government with no substantial source of income and no credit history at rates lower than other private loans? With subsidized loans, they even pay the interest while the student is in college!

Last year when my daughter was accepted into eight California colleges the funds seemed to follow the affluence of the college. In other words the private and most expensive colleges gave the most money. The California Universities offered packages that covered tuition. The CSUs offered mostly nothing. We are a middle now heading to low income family as my husband is retired. In the end what I found, in California, is that all of the colleges gave packages that almost all matched one another. The privates remained somewhat higher, but I think that is to be expected. I truly feel that they are trying to stay competative with each other…

The up side is that one can choose what they want without signifigant variation…..realize that the awards my daughter was offered were not based on academics, but need. In her case she chose a CSU which in fact cost us close to the privates….go figure.

Lynn, I am also interested in knowing what schools give good academic scholarships. We have a high EFC as well and do not want huge loans for our kids once they are out of college. We are going through the college admission process right now, and it is heartbreaking. We saved as much as we could, but the cost of college just keeps getting higher every year. It may have been doable, but we have three children to get through college. My daughter was lucky enough to get into UT with that 10% rule in place. We may have to give up any hope of having her attend the private schools she applied to. We just don’t want to look at private schools with the other two. We learned our lesson with the 1st and will have to go the route of state/community colleges. I read too many books that gave false hope regarding merit scholarships and how to obtain them….

HI Lisa,

Unfortunately, a lot of families are in your position. One thing you should keep in mind is that if your children are spaced close together, your EFC for all of them will drop. With two kids in school, each child’s EFC would be reduced by roughly 50% for the FAFSA and 30% for PROFILE schools. You should use net price calculators of different schools to see what the price would be for one, two and three kids in school simultaneously.

State schools could be your cheapest option, but don’t overlook four-year grad rates of schools. UT Austin has a low grad rate compared to many of its peers and the university just released a report that addresses how it can improve its four-year rate. The four-year grad rate is only 51%! So you might need to compare the five-year cost of a state school versus a four-year rate for some private schools.

Good luck!

Lynn O’Shaughnessy

Wow Joe, that’s an incredible graph! Thank for for posting this. I agree with you on your observation.

Lynn – Does anyone ever publish a list that has schools that hand out “Academic” money? With an EFC of 20K (yeah right)….we don’t qualify for the education superlotto. My daughter is a freshman at CSUF…..after getting accepted last year to some of the schools on the above list…got some great grant money from those schools, but still would leave her with 20K per year in loans…in the end, that was something she didn’t want to burden herself with upon graduation or us with….I have a couple more years until my son goes to college…and he will be in the same situation…awesome grades and SAT scores, but not getting much financial aid due to our high EFC….so ….I am trying to put it all together and see if there are schools out there that offer more Academic money to students than others…any ideas?

Lynn, this is a good example of accurate data telling only half the story.

If you look here: http://bit.ly/AlLNCF you can see a quick little visualization I did with IPEDS data. The x-axis shows institutional wealth: The farther to the right, the wealthier an institution is (using net assets per student). The y-axis shows percent of students receiving Federal Aid. The lower you are, the richer your student body is.

The bubble is sized by the percentage of the student body that is African-American or Hispanic; and it’s colored by group: Red bubbles are those institutions that meet full need; while blue bubbles are a set I work with frequently: Large Catholic Universities that don’t. BC and Georgetown are red, as they were on the list.

Note that the institutions that “Meet Need” have very few students with need, in general. And they are, ironically, the institutions who would have the means to support more of them, should they choose to do so. Strike you as ironic?

Lynn, this is a good example of accurate data telling only half the story.

If you look here: http://bit.ly/AlLNCF you can see a quick little visualization I did with IPEDS data. The x-axis shows institutional wealth: The farther to the right, the wealthier an institution is (using net assets per student). The y-axis shows percent of students receiving Federal Aid. The lower you are, the richer your student body is.

The bubble is sized by the percentage of the student body that is African-American or Hispanic; and it’s colored by group: Red bubbles are those institutions that meet full need; while blue bubbles are a set I work with frequently: Large Catholic Universities that don’t. BC and Georgetown are red, as they were on the list.

Note that the institutions that “Meet Need” have very few students with need, in general. And they are, ironically, the institutions who would have the means to support more of them, should they choose to do so. Strike you as ironic?