Student loan debt is at its highest level ever.

That’s the conclusion of a new report released on Thursday by The Project on Student Debt.

Two thirds of students in the class of 2010 graduated with college debt that averaged $25,250, which is the highest it’s ever been. Students mostly borrowed through federal loans, but at least 22% of the student debt came from riskier and more expensive private college loans.

States With the Highest Student Debt

Students from the Northeast and Midwest got slammed the hardest. I’m assuming that’s because more students in those regions attend private colleges and universities. In the chart below, you will see what the average student borrower from the class of 2010 owed.

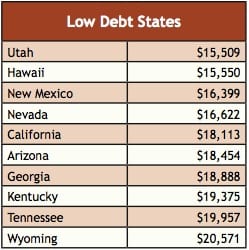

States With the Lowest Student Debt

The states where students graduated with the lowest debt were in the West and the South. In these two regions, students are far more likely to attend public universities that are lower priced.

A Look At California

If you’re a Californian, you might be surprised to see California on the list of the lowest debt states. I know I was. Keep in mind, however, that these figures were generated by students who typically started college in the mid 2000’s. The prices weren’t nearly as high back then.

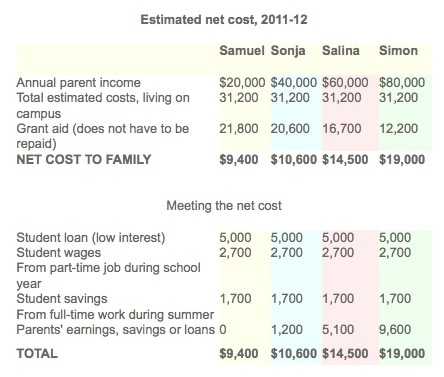

After financial aid, the price of a University of California education can be staggering for low and middle-income families. As you can see from the chart below that I pulled off the UC website, a family making $20,000 a year is somehow expected to pay $9,400 for one year of college!! Yeah, right.

Hall of Shame: Private Schools With the Highest Student Debt

Finally, the Project on Student Debt’s report included a list of schools with the highest student loan debtors. Students of the private schools listed below graduated with debt ranging from $40,400 to $55,250. That’s mind boggling! I should note that on this list are five art schools and five Catholic institutions. I did not consider this surprising since art schools are notoriously stingy and so are many medium-sized Catholic universities. Consider yourself warned.

Public Universities With the Highest Student Debt

Here are the public universities that produce graduates with the most debt. The public school debt ranged from $29,800 to $45,350.

Lynn O’Shaughnessy is the author of The College Solution and she also writes a college blog for CBSMoneyWatch.com and US News & World Report. Join her on Facebook.

Read More on The College Solution:

Where Most Students End Up Attending College

Attending College in a Different Time Zone

Californians are reeling from 19% unemployment (includes: those forced to work part time; those no longer searching), mortgage defaults, loss of unemployment benefits. And those who still have jobs are working longer for less. Faculty wages must reflect California’s ability to pay, not what others are paid.

Current pay increases for generously paid University of California Faculty is arrogance. Instate tuition consumes 14% of Ca. Median Family Income!

Paying more is not a better education. UC Berkeley(# 70 Forbes) tuition increases exceed the national average rate of increases. Chancellor Birgeneau has molded Cal. into the most expensive public university.

UC President Yudof, Cal. Chancellor Birgeneau($450,000 salary) dismissed many much needed cost-cutting options. They did not consider freezing vacant faculty positions, increasing class size, requiring faculty to teach more classes, doubling the time between sabbaticals, cutting & freezing pay & benefits for chancellors & reforming pensions & the health benefits.

I always come away from these studies and reports frustrated by the details in what data is collected and what is left missing or un-addressed. In this report, The Project on Student Debt, what is glaring to me is the omission of information on the Parent Plus Loan. It’s great that the study includes private loans made to students, which reportedly makes up about 22% of the overall student debt. But it seems nonsensical that they are collecting information on total student debt, which the report indicates includes co-signed loans, but excludes the PLUS loans. Since the PLUS loan is most likely the first option after the Stafford limits are used up, and before private loans are pursued, i would think that the PLUS loan would add a considerable % to the numbers reported here. i would love to know how adding the PLUS would increase these numbers.

Good information and an interesting read, but this glaring omission of important data leaves me scratching my head on how they would go to the trouble to put together such a comprehensive collection of information, while leaving out such an important component. Ugh.

Wow, there are some shockers on there! Interesting….