I heard this week from a father from Southern California whose son will soon be starting his sophomore year at American University in Washington DC. He has a daughter who is also interested in attending college on the East Coast.

Here is part of his email:

My son loves AU which fits his interest in politics and government, but as you have documented, it is not particularly generous with financial aid. We knew this going in, but it has gotten worse as he heads into his second year.

The father was asking how he can find a more generous school for his daughter and I’ll address that in a different post, but today I want to use this family’s dilemma as a cautionary tale.

When parents look at colleges they assume that whatever financial aid they receive during their child’s freshman year will remain the same for four years as long as their financial situation doesn’t change. Some assume that the aid will increase as the cost of the school climbs.

Higher-Ed Bait and Switch

In reality, however, some schools practice the higher-ed version of the bait and switch. They offer the best packages to high school seniors who are often shopping for the best deal. Once the students have gotten settled in, the schools offer subsequent packages that are stingier. Schools figure, “Hey, is this kid really going to leave if we shave a few thousand dollars from his package?”

How can you tell if a school is going to pull a bait and switch on your child?

The best way is to check an institution’s past behavior. You can look at a school’s financial aid track record by heading over to COLLEGEdata, which is a great resource for researching the generosity of colleges and universities.

When I checked out American University’s track record, I was shocked at how much the financial support drops for students after their freshmen year.

To retrieve the relevant statistics for any school, click the Search for Colleges link on COLLEGEdata’s home page. Then type the name of the university in the box. After pulling up the school’s profile, click on its Money Matters link.

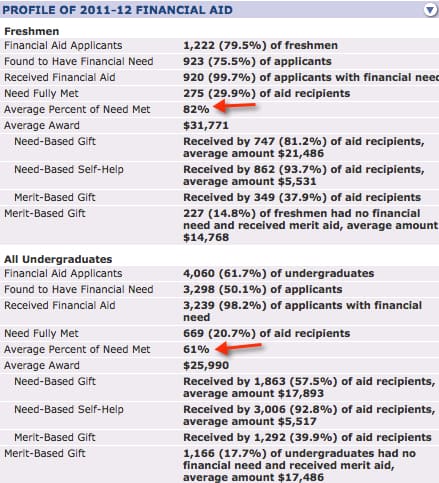

Here is what I found for American University:

The top red arrow shows the percentage of financial aid that American University says it typically meets for freshmen. The school says that it meets 82% of need and that includes a federal student loan. I should mention that the figures for all schools are self reported and not verified.

Next take a look at the figure that the second red arrow is highlighting. The school admits that it only meets 61% of need for all undergraduates. Since freshmen are also included in this number, the percentage for other undergrads has to be even lower! So once students at American University get their first financial aid packages good luck with the next three years!

Hall of Shame Schools

As I’ve mentioned many times before, schools located in cities on the East and West Coasts, which aren’t among the most elite, tend to offer mediocre financial aid packages. Fitting this description are such schools as:

- American University

- Catholic University

- Drexel University

- Fordham University

- Loyola Marymount University

- New School

- New York University

- Northeastern University

- Pratt Institute

- St. Joseph’s University

- Santa Clara University

- University of San Diego

All the schools in the above list are on the federal government’s hall of shame list that is comprised of the top five percent of colleges and universities that charge the nation’s highest net prices after typical scholarships and grants are deducted. You can see the whole list at the federal College Affordability and Transparency Center.

One last thing that I’d like to point out is the average need-based grant of $17,893 for all AU undergraduates at American University is almost identical with the average non-need-based aid – merit scholarships for rich students – $17,486. Does anybody else find it appalling that this school gives nearly the same amount of money to wealthy students as it does to those who truly need a helping hand?

Bottom Line:

Don’t judge a college or university solely by how it treats it freshmen. Also judge the school by how it treats its other students when fewer people are watching.

Totally agree. I was a victim of the University of San Diego School of Law’s bait and switch financial aid tactic 30

years ago. Turned down more prestigious schools on its false representation. Big mistake. Glad you’re spreading the word! Won’t allow my kids to apply to any of these schools!

Merit aid doesn’t necessarily go to ‘rich’ students, you are assuming it is going there. If people pick the college for the aid of whatever kind they are obviously cost sensitive. Many find it absolutely offensive to have to fill out the financial data on FAFSA and would rather get merit aid if their children’s stats will carry the weight. And merit aid requires merit, so no, I am more offended at those who are offended by colleges using their own money to attract good students as if there were an alternate entitlement to that, then I am at colleges doing so.

Chris – Merit aid typically has nothing to do with merit. Eight seven percent of students who attend private schools receive “merit” aid. It’s more accurate to call this money tuition discounts that colleges use as part of their enrollment management strategies.

Lynn O’Shaughnessy

This is great cautionary post, I had not realized some schools did this. I actually received better financial aid during my later years and as my grades went up at the UW-Seattle. So very lucky for me.

Lynn,

Thanks for posting this. I heard about this type of practice earlier this summer and could not believe my ears!

It is appalling to me that colleges do this!

Thanks for showing us how we can protect ourselves!

This is very helpful information!

Very interesting information! I came across the college data site when putting together a spreadsheet of schools that my daughter is considering. I saw this type of data but didn’t really understand its significance before reading your post. I do have one issue that I would like raise however – that is the idea that only kids that meet the ‘financial need’ definition should get merit awards.While not explicitly stated – it is certainly the idea that comes through in several comments. I believe that merit awards should be based on just that – merit. Not the parents income. I’m surprised and I must say disappointed that ‘rich’ is now a dirty four-letter word – the gifts given back to schools by alumni are a large part of the need-based aid given to students every year.

“Does anybody else find it appalling that this school gives nearly the same amount of money to wealthy students as it does to those who truly need a helping hand?”

Only 14% of non-need freshman got merit aid, while close to 40% of financial need students received merit aid in addition to need-based aid. That doesn’t seem so appalling to me.

If you look at the number of freshman vs. the number of undergraduates, it is clear there is a lot of attrition – almost 25% of each class. I would speculate that the higher-need students (who had larger than average packages as freshmen) are dropping out at a higher rate, for a variety of reasons. This would lower the average award in future years. In addition, those with larger merit scholarships have more incentive to work harder and stay, so the average merit award will increase over time as well.

No bait and switch, just a shifting student population.

Great article Lynn!

I had no idea that colleges were essentially “baiting and switching”. My son is a junior this year and when evaluating offers and schools, I will definitely make sure to check CollegeData for further investigation. Everyone needs to make sure we fully understand what the finances will look like Freshman year and beyond.

Very interesting read. Thanks!

You are very welcome Celest! Good luck with the college search.

Lynn O’Shaughnessy

Hi Lynn,

I love using College Data for just this kind of information. One thing that gives me pause, though, is that I’ve found some mistakes in the data on College Data in the past. For instance, I noticed a similar stated trend for Swarthmore a few months ago. It didn’t feel right to me that Swarthmore was awarding less aid to upperclassmen, so I called their financial aid office and asked about it. It turns out that the data on College Data was incorrect and Swarthmore was thankful to have had the mistake pointed out. I called College Data about some other minor discrepancies similar to that one. I have found them to be wonderfully nice. I guess when they deal with so much data, little mistakes will appear. I trust them, but I am careful not to simply believe all the numbers I see on their site when they seem out of sync. When the numbers don’t look right, it’s important to dig a little deeper.

Thanks Karen. I could see why you would question Swarthmore’s numbers since it does meet 100% of need of its students.

In American’s case, I suspect that the freshman percentage of need is the ones that’s off. I know someone familiar with American financial aid awards and he thinks the average frosh awards are in the 60ish percentile of need!

Lynn O’Shaughnessy

This is very sad for families who rely on aid to help offset the skyrocketing cost of tuition. Lynne, do you have an feeling for if and how this ‘bait and switch’ contributes to the high 30% transfer rate by graduation?

I’m not sure I read American’s profile correctly: Did the merit aid increase after the first year? If yes, is that the norm?

Helen — The average merit scholarship for rich students did increase from freshman year. I think that is unusual.

Lynn O’Shaughnessy

Those are amazing numbers, Lynn! That colleges will not meet all the financial need aid and yet give money to wealthy families as merit aid is bad enough. And that the financial need students get less as the years go along is even worse. Someone more cynical than me may think that these schools are making an “investment” in these wealthy students for potential future gifts!

When we were evaluating merit-based offers for our daughters, we became clear which offers were “guaranteed” for four years and under what conditions. It had an impact on how we ranked the schools.

Chuck, you don’t have to be cynical to think colleges are looking to make an investment…they are! There was just an article on it in the New York Times: http://www.nytimes.com/2013/09/29/magazine/freebies-for-the-rich.html?goback=.gde_78767_member_276806029&_r=0#!

“Colleges are businesses and look to their students and their families as future contributors.

Have you ever heard of the “4 for 40″ mantra? The university will help you for your four years of college and you will help them for your forty working years. (And when you pass, a portion of your life insurance as well, if the Charitable Giving Dept. did their job well!)” says Jim Lundgren, President/CEO at Access College Foundation

This is extremely important to know. I didn’t realize that colleges did that, and I’m guessing most families are unaware of it as well.

Very helpful topic, Lynn! I also like to remind people that your financial picture can look different every year, so any need-based aid can fluctuate just based on the numbers on your FAFSA, CSS Profile, or whatever form the school is using for institutional need-based aid. If you know that your income is going to jump up sometime over the next four years, it’s best to look for a school where you are getting all or mostly merit aid and not need-based aid. Otherwise, you are faced with paying more for college out of your cash flow, if you can, or trying to convince the financial aid office that your extra income is allocated to something other than college and argue that they should still give you the same amount of need-based aid.